5 Tips for Forex Trading Beginners

Looking for even more information to get yourself a head start over the competition when trading Forex? Smart move! As a forex trading beginner, knowledge is your best weapon to ensure that you’ll be able to effectively predict which currencies will increase and decrease in value, and will lead you to more steady profits and better investments.

Read on to learn five more tips to help beginner investors to expand their portfolio effectively and profitably, and see fewer losses when starting out on the market.

1. Don’t be afraid to shop for brokers:

The importance of choosing the right broker simply cannot be overstated. Yet, this is a step that beginners often ignore, instead choosing the first broker they can find or going with a broker whose website sounds good without comparing. When trading Forex, you won’t have to pay fees on each trade like you would if you were stock trading. Instead, brokers charge a spread between the “bid” and the “ask” price of each currency. This means that, if you choose a broker who is overcharging you, you have the potential to see all of your hard-earned progress go down the drain. There are some brokers however who have adapted the ECN model who charges commissions instead of Spreads.

The solution? Don’t be afraid to invest some time finding a fair and reliable broker to work with. Locate a website that offers independent broker reviews like Trading101.com in order to see what types of experiences other traders have had and to compare the benefits and drawbacks of working with each choice. People can choose to invest through micro account forex to start trading in stock market.

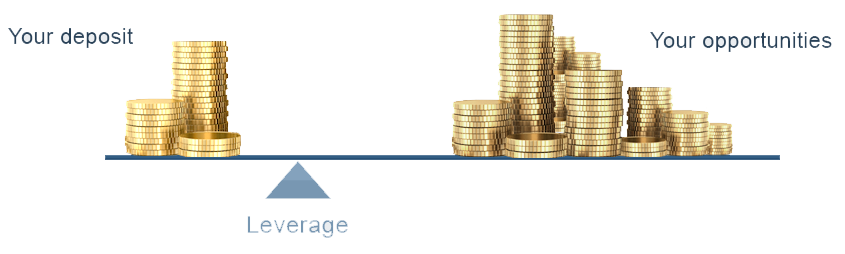

2. Be careful with Leverage:

Until recently, Forex trading was limited to banking institutions, major corporations, and governments because the minimum deposit was worth about $100,000. Obviously, this limitation made Forex Trading out of reach for most independent traders. Now, Forex trading is done “on the margin,” meaning that you can garner ratios to trade instead of investing massive amounts of your own money. This is called “leverage,” and it’s extended to you by your broker; Leverage levels typically range from 1:1 up to as high as 1:1000. If for example, you selected 1:100 leverage, then for every dollar that you put into your Forex trading account, you can trade $100 on the Forex market.

Although Leverage allows clients to open bigger positions, this means that clients’ equity can be affected dramatically both positively as well as negatively, and is probably the main cause of why clients lose money most of the time. The higher the leverage, the higher the risk, but unless you have a substantial balance to deposit to open large positions, profits or losses won’t be much with leverage of 1:1 unless something extreme happens in the market.

3. Start with a focus on a single currency pair:

When you first begin Forex trading, it can be tempting to stick your nose into every currency pair and try to jump between multiple currencies trying to make a profit. A better strategy when you’re first starting out is to focus on trading a single currency pair. This way, you can become intimately familiar with the fluctuations in value of your currency of choice, which is a transferable skill that will greatly help you to expand into other currency pairs later down the road.

For your first trade, try to choose a currency pair that you are academically interested in, or at least that you have a working knowledge of. This will make learning more about the economics and culture of your chosen currencies easier and more fun.

4. Automate your trading:

Automated trading systems are a beginning Forex trading hopeful’s dream come true. They are able to remove all of the emotions that frequently interfere with trading. Automated trading systems are available with most brokers, and allow you to set “rules,” entry and exit points, and updates to your trading system periodically. Then, the script/expert adviser/robot does all of the work for you, and you get to sit back and watch your money grow!

Finding the right automated trading system that works for you is much like finding the right broker. Reading unbiased reviews, comparing systems and testing them out for yourself, and taking time to do your research will help you immensely and improve your trading.

5. Choose a reliable news network:

Politics and economics have major influence over the value of every currency in the world. As a smart trader, you’ll want to keep up to date with the political movements and economic reports of country in which you have invested currency. But many news networks have a political bias, and selectively report facts that align with what their audience wants to hear. These types of news sources will be useless to you as a trader, so taking time to thoroughly research where your news is coming from will be an essential part of building a successful trading portfolio.

According to a report by Journalism.org on the political lean and bias of different news outlets, some of the most reliable sources of financial news include CNN, PBS, NPR, and BBC. These are some great options if you are just starting out searching for your news outlet of choice.

The world of Forex trading is fun and exciting, but to see high profits you’ll need to educate yourself on the ins and outs of the Forex trading market. Trading101.com has a host of simple, clear tutorials and outlines to get you started building your trading profile. Our ebooks, webinars, and videos were all made with beginners as well as advanced traders in mind, and we’ll help you every step of the way as you start to get the hang of Forex trading. The best part? It’s all totally free and all you need to do is sign up for an account.

Begin Forex trading and living the life that you deserve today with Trading101.com. There’s no excuse- sign up for a free account to get started!

Read More :