- Defining Green Financing

- Defining Traditional Financing

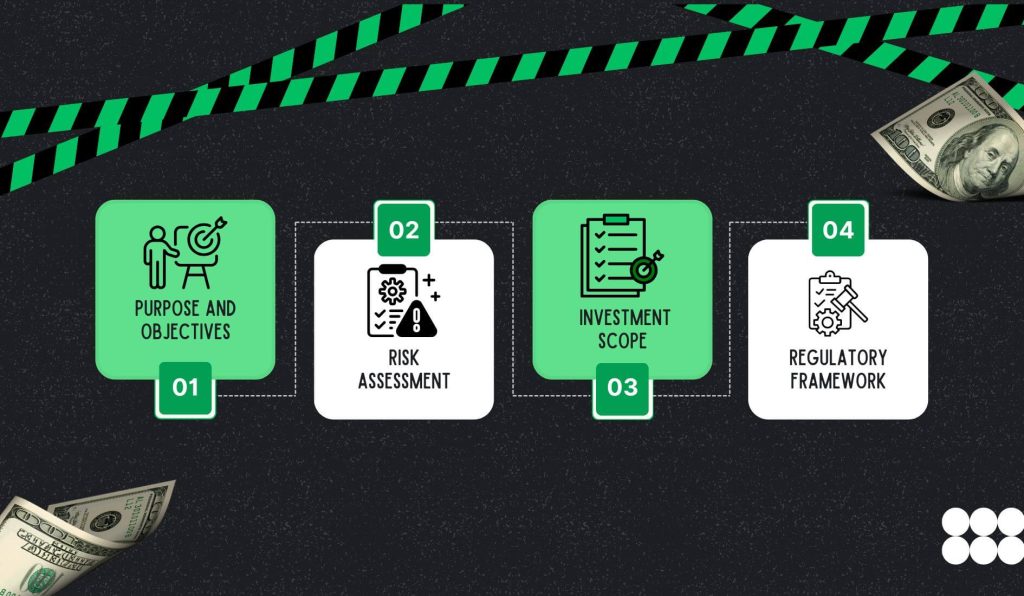

- Core Differences Between Green and Traditional Financing

- 1. Purpose and Objectives

- 2. Risk Assessment

- 3. Investment Scope

- 4. Regulatory Framework

- Financial Instruments in Green and Traditional Financing

- 1. Green Bonds and Loans

- 2. Traditional Bonds and Loans

- Economic Implications: Cost and Return Analysis

- What Are the Environmental and Social Impacts?

- Major Challenges/Limitations of Green and Traditional Financing

- Future Outlook: Trends and Innovations

- Making Informed Financial Decisions!

- Frequently Asked Questions (FAQs)

Green Financing vs Traditional Financing: Key Differences

Financing has always been the backbone of economic growth. In fact, it is the fuel behind the engine, from building bridges to launching startups. However, the landscape is changing now.

Now, factors like climate change, resource depletion, and rising social awareness have pushed the financial world to rethink its priorities. That is when green financing came to the fore. It is a model that does not just chase profits but also aims to protect the planet. Moreover, it is not just a buzzword anymore but a movement.

Defining Green Financing

Green financing is not merely about planting trees or funding solar panels. Rather, it is a structured approach to channel capital into projects that make a positive environmental impact. Some examples include the following:

- Renewable energy

- Clean transportation

- Sustainable agriculture.

Basically, the idea is simple- Use money to fix what money helped break. Hence, green financing includes tools like green bonds and green loans, which come with specific criteria and reporting standards. Thus, green financing is not vague but measurable.

Defining Traditional Financing

If you flip the coin now, traditional financing has been present for decades. It is straightforward. All you have to do is raise capital, invest, and earn returns. Hence, no strings attached and no environmental checkboxes. Essentially, it is sector-agnostic, profit-based, and risk-aware.

On the contrary, traditional financing mostly overlooks long-term sustainability. For instance, with conventional/traditional financing, people fund the following:

- Fossil fuels

- Deforestation

- High-emission industries

Although it is not malicious, it is just indifferent.

Core Differences Between Green and Traditional Financing

The following are some of the major differences between green and traditional financing:

1. Purpose and Objectives

Primarily, green financing is not merely about money. Rather, it is about social responsibility. In this case, the goal is to fund projects that do the following:

- Reduce carbon footprints

- Conserve biodiversity

- Promote clean energy.

Meanwhile, traditional financing is fully focused on ROI. If a coal plant promises high returns, it will get the money it requires. In this case, green financing would walk away. That is the major philosophical divide.

2. Risk Assessment

If you carefully observe, risk looks different depending on the lens. In general, traditional financing evaluates market volatility, creditworthiness, and interest rates.

Meanwhile, green financing adds layers. These include climate risk, regulatory shifts, and reputational damage. It is not just about losing money. It is about losing credibility. Losing the planet.

3. Investment Scope

This is where things get real. Essentially, green financing targets the following sectors:

- Wind energy

- Electric mobility

- Sustainable agriculture.

Although green financing is still niche, it is growing rapidly. On the other hand, traditional financing is everywhere (tech, oil, real estate, retail, etc.). In the latter, the investment scope is broader, but not always future-proof.

4. Regulatory Framework

Of course, green financing does not operate in a vacuum. In fact, environmental standards, ESG guidelines, and third-party audits bind it.

Meanwhile, traditional financing faces less scrutiny and fewer disclosures. Hence, it is faster, but not always cleaner.

Financial Instruments in Green and Traditional Financing

The following are the respective financial instruments in green and traditional financing:

1. Green Bonds and Loans

These are not merely rebranded products. Rather, green bonds are issued to fund eco-friendly projects, with strict use-of-proceeds clauses. Moreover, green loans come with sustainability-linked terms.

Hence, if you miss your environmental targets, pay a higher interest rate. Basically, it is accountability in action.

2. Traditional Bonds and Loans

These are standard financing. In general, these consist of bonds for infrastructure and loans for expansion. Also, you do not have to attach yourself to any environmental strings. It is flexible, fast, and familiar. However, it lacks the precision of green instruments.

Economic Implications: Cost and Return Analysis

In 2024, a study in ScienceDirect found that green assets might be costlier upfront due to compliance and reporting. However, they mostly yield competitive returns over time. This is due to the following factors:

- Lower operational costs

- Tax incentives

- Growing demand.

In addition, cost analysis is not merely about sticker price. Rather, it is about lifecycle value. Although traditional financing may look cheaper, there are actually hidden costs (environmental damage or regulatory fines). These might fully flip the equation.

What Are the Environmental and Social Impacts?

When it comes to environmental and social impact, green financing shines. It is not about profits but about the greater impact. In this case, the benefits include cleaner air, safer water, and resilient communities.

Meanwhile, traditional financing is more like a hit-or-miss. Some projects help while others harm. In this case, the difference lies in intent.

Apart from that, green financing is designed to deliver environmental impact and social responsibility. Traditional financing might do so accidentally.

Major Challenges/Limitations of Green and Traditional Financing

Obviously, green financing comes with some limitations. In fact, it is complex, slow, and sometimes expensive. Also, reporting requirements are a nightmare. There is also the risk of greenwashing (projects marketed as sustainable but are not).

Traditional financing is a lot easier to comprehend and invest in. In fact, you will be able to do it faster. However, it is blind to long-term risks. Basically, both models have flaws, and hence, the key is transparency.

Future Outlook: Trends and Innovations

The future is leaning green. AI-driven ESG scoring, blockchain-based green bonds, climate risk modeling — it is all happening. Traditional financing is adapting too, integrating sustainability metrics. But green financing is leading the charge. It is not just a trend. It is a transformation. ScienceDirect – Green finance development and its origin, motives

Making Informed Financial Decisions!

Choosing between green financing and traditional financing is really easy. All you have to do is focus on your long-term goals, values, and risk-taking ability. In fact, if you care about sustainability, transparency, and long-term impact, green financing is right for you.

However, traditional financing might suit you better if speed, flexibility, and short-term gains matter more. Either way, focus on making better decisions. This is because the financial world is constantly evolving.

Frequently Asked Questions (FAQs)

The following are some of the most common questions you will come across regarding green financing and traditional financing:

Primarily, traditional financing focuses on financial returns. Meanwhile, funding green incorporates environmental and social considerations.

To be honest, some studies suggest that green loans may have slightly higher costs. This is mostly due to additional reporting requirements.

In general, projects that are eligible for green financing focus on the following:

• Renewable energy

• Energy efficiency

• Pollution prevention

• Sustainable agriculture

Some of the major risks of green financing include project implementation challenges, regulatory changes, and potential greenwashing.

Most studies indicate that green investments are as profitable as traditional investments. However, it is important to focus on long-term requirements.