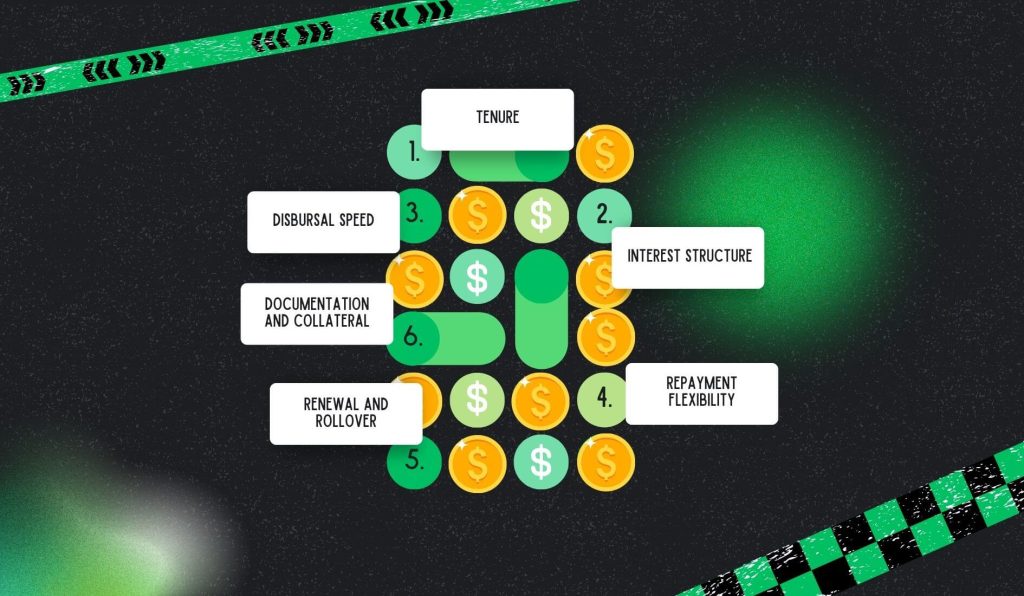

- Essential Features of a Working Capital Demand Loan

- 1. Tenure

- 2. Interest Structure

- 3. Disbursal Speed

- 4. Repayment Flexibility

- 5. Renewal and Rollover

- 6. Documentation and Collateral

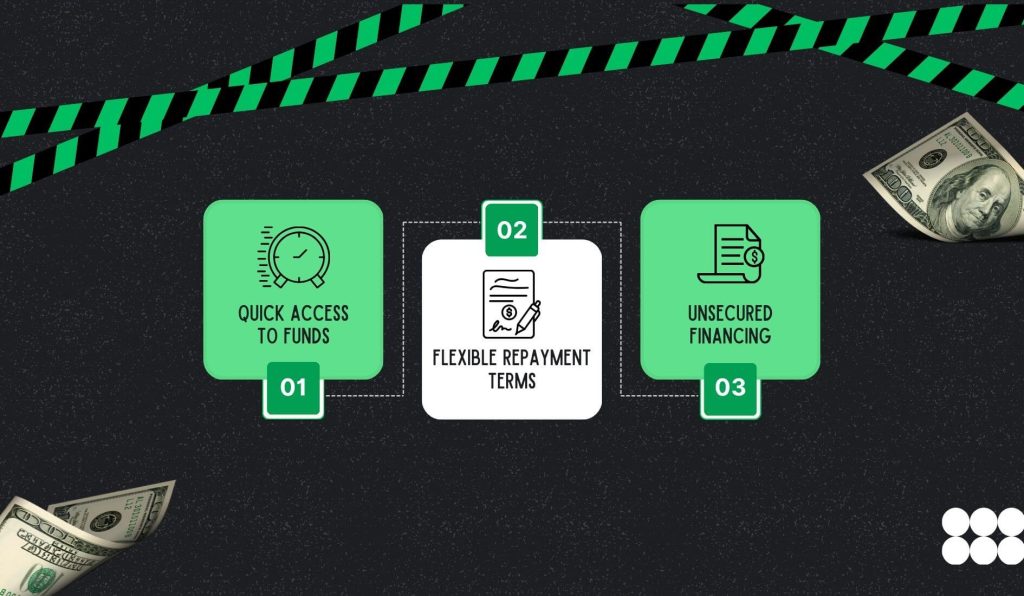

- Major Advantages of a Working Capital Demand Loan

- 1. Quick Access to Funds

- 2. Flexible Repayment Terms

- 3. Unsecured Financing

- Major Risks and Considerations of WCDLs

- 1. Higher Interest Rates

- 2. Short-Term Nature

- 3. Potential for Over-Borrowing

- Eligibility Criteria for WCDLs

- WCDLs are Strategic for Business Financing

- Frequently Asked Questions (FAQs)

Advantages and Risks of Working Capital Demand Loans

Primarily, a Working Capital Demand Loan (WCDL) is not your typical business loan. It is short-term and fast-moving. Also, it plugs gaps in your business cash flow. Think of it as a financial patch and not a permanent fix. However, it might be a quick solution when things get tight.

Unlike term loans or overdrafts, WCDLs are demand-based. This means lenders will be able to recall them at any time. Meanwhile, businesses in the U.S. mostly use WCDLs to cover payroll, inventory, or unexpected expenses.

However, WCDL is flexible, but it is not without strings. And that is what makes it both useful and risky. Therefore, read on to get a better idea of WCDL.

Essential Features of a Working Capital Demand Loan

Primarily, a Working Capital Demand Loan (WCDL) is built for speed and simplicity. They are not meant to be long-term solutions. However, they are highly effective for short-term business financing.

The following are some of the major features of WCDLs that you must be aware of:

1. Tenure

In general, WCDLs are short-lived. In fact, most range from 30 days to 12 months. Basically, that helps cover temporary gaps rather than fund expansion or capital expenditure. In this case, you borrow, you use, you repay. Moreover, the cycle is fast.

2. Interest Structure

Unlike traditional loans, which charge interest on the full sanctioned amount, WCDLs charge interest only on the amount you utilize. That is a big win for businesses trying to keep costs lean.

Let’s say the lender sanctioned you $100,000, but you only used $40,000. Then, you have to pay interest on $40,000. This is because it depends on your usage. That is why WCDLs are efficient.

3. Disbursal Speed

Most lenders (especially digital-first platforms) process WCDLs within 48 to 72 hours. In fact, some even process faster. That is crucial when you are dealing with urgent payroll, supplier payments, or inventory restocking.

Also, you do not have time to wait for board approvals or multi-layered underwriting. All you want now is access to cash.

4. Repayment Flexibility

The following are some of the major loan options that lenders come up with:

- Monthly EMIs

- Quarterly payments

- Even bullet repayments

Meanwhile, some allow early foreclosure without penalties, which is rare in the lending world. This is the kind of adaptability that helps businesses align repayments with their revenue cycles. Also, if you are seasonal, you do not want rigid monthly payments.

5. Renewal and Rollover

If your business constantly requires working capital, some lenders allow you to renew the WCDL after the initial tenure. However, it is not automatic. In this case, you might have to meet updated loan eligibility criteria, and your repayment history plays a big role.

6. Documentation and Collateral

WCDLs are typically unsecured business loans. That means you do not have to deal with property, machinery, or inventory pledges. Rather, you will have to show the following:

- PAN

- GST

- Bank statements

- Audited financials (sometimes).

Hence, that is a relief for small businesses and startups that do not have many assets. Also, it lowers the entry barrier and speeds up the process.

In short, WCDLs are fast, flexible, and lean. They are not perfect, but they are practical, especially when your business needs a quick fix. Moreover, it is not a long-term commitment.

Major Advantages of a Working Capital Demand Loan

The following are some of the major advantages of a working capital demand loan (WCDL):

1. Quick Access to Funds

With a Working Capital Demand Loan, speed is the name of the game. Basically, WCDLs are known for their fast approval and disbursal. In fact, some lenders process them in under 72 hours. That is a lifesaver when your business hits a cash crunch.

So, whether it is a seasonal dip or a surprise expense, WCDLs help you stay afloat. Moreover, the turnaround time is significantly shorter than traditional loans.

2. Flexible Repayment Terms

Repayment is not rigid with WCDLs. It lets you choose monthly or quarterly EMIs. Meanwhile, some lenders even allow early closure after the first EMI without extra charges.

That kind of flexibility is rare in short-term business financing. Essentially, it lets you align repayments with your revenue cycles, which is crucial for businesses with fluctuating income.

3. Unsecured Financing

You do not have to keep collateral in a WCDL. That is the standout feature. Typically, WCDLs are unsecured business loans. This means you do not have to risk your assets.

Hence, for startups or small businesses, that is a game-changer. In this case, you get the funds without pledging property, machinery, or inventory.

Major Risks and Considerations of WCDLs

The following are some of the major risks and considerations you must be aware of WCDLs:

1. Higher Interest Rates

To be honest, WCDLs mostly come with higher interest rates. It typically ranges between 11% to 16% annually. That is steep compared to long-term loans. This is because you are paying for speed and flexibility. But if you are not careful, the cost might outweigh the benefit.

2. Short-Term Nature

These loans are not for the long haul. In fact, most WCDLs have tenures of 6 to 12 months. That means you have to repay quickly. Also, if your business does not generate enough cash flow in that window, you might be in a bind.

3. Potential for Over-Borrowing

Sometimes, easy access might be a trap. For instance, some businesses might lean too heavily on WCDLs to cover recurring expenses. That is risky.

Moreover, over-borrowing leads to debt cycles. Actually, you are constantly repaying one loan with another. Hence, it is a slippery slope if you fail to manage it wisely.

Eligibility Criteria for WCDLs

Primarily, WCDL loan eligibility depends on a few key factors. First, lenders look at your credit score, business turnover, and repayment history. Apart from that, some even provide you with pre-approved business loans depending on your financial profile.

Hence, the following things you have to show when you are applying for a loan:

- A registered business with operational history

- Minimum annual revenue (varies by lender)

- Good credit standing

- Valid documentation (PAN, GST, bank statements)

In general, platforms like Fibe simplify the process. In this case, you have minimal paperwork and fast approvals.

WCDLs are Strategic for Business Financing

You might have already understood that a working capital demand loan is not a one-size-fits-all solution. It is fast, flexible, and unsecured. Hence, it is perfect for short-term needs. However, it is also expensive and temporary.

Hence, if you run a business, you must weigh the pros and cons before diving in. Essentially, use the loan to bridge gaps, not to lay foundations. If you manage it well, WCDLs are powerful allies in your financial toolkit. Therefore, do not let convenience cloud your judgment.

Frequently Asked Questions (FAQs)

The following are some of the most common questions you will come across regarding WCDLs:

Essentially, WCDLs are short-term, unsecured, and demand-based. So, unlike term loans, they are possible to recall anytime. Also, they do not require collateral.

The following are the major advantages of a Working Capital Demand Loan:

• Quick access

• Flexible repayment

• No collateral.

Hence, it is ideal for managing short-term cash flow issues.

The following are the major risks of applying for a WCDL:

• Higher interest rates

• Short repayment periods

• Risk of over-borrowing.

If you want to apply for a WCDL, you must have a stable revenue, good credit scores, and proper documentation. In fact, some lenders come with pre-approved options.

No. WCDLs are best for short-term operational requirements. If you want to invest for the long term, you must go for structured financing.