Understanding the Role of Micro ATMs in Financial Inclusion

Presently, the need for financial inclusion is dire. In fact, there is still a long way to go. That is the sentiment that echoes across India’s hinterlands when it comes to banking. This is where the concept of Micro ATM comes in.

In some villages, the nearest bank branch is 20 kilometers away. Also, there are no ATMs or digital kiosks. Everything is cash, and sometimes not even that.

The Governor of the Reserve Bank of India, in a recent address, emphasized how financial inclusion is not merely a policy goal. Rather, it is a necessity, especially when over 190 million adults in India remain unbanked.

The problem is not just distance. It is more about trust, literacy, and infrastructure. Also, rural banking has always been a challenge.

Although mobile banking apps and UPI are great, they do not solve everything. For instance, many people do not own smartphones or struggle with digital interfaces. That is where the Micro ATM steps in, not as a replacement, but as a bridge.

What is a Micro ATM?

Think of Micro ATM as a mini bank in a box. Basically, a Micro ATM is a handheld device that is lightweight and portable. Moreover, it can perform basic banking functions. Also, it does not spit out receipts like a traditional ATM. However, it gets the job done.

In general, these devices are designed to operate in low-connectivity zones. Apart from that, it can authenticate users using Aadhaar or debit cards.

They are not meant to replace full-service ATMs. Instead, they complement them. These are useful especially in areas where setting up a full ATM is just not feasible (financially or logistically).

In most cases, a business correspondent operates micro ATMs. It is either someone local or someone trusted.

Key Features of Micro ATMs

The first major feature of a Micro ATM is portability. Basically, the operator will be able to carry these devices in a backpack. Hence, there is no need for air-conditioned rooms or security guards. All you need is a stable internet connection (even mobile data works).

Moreover, biometric authentication is a core feature of Micro ATMs. That means it supports fingerprint scans, Aadhaar verification, and secure PIN entry.

In addition to that, the setup costs are minimal. For instance, you do not need lakhs to deploy a Micro ATM. All you need is a few thousand rupees and a basic training session.

Micro ATMs are built to be rugged, too. They are dust-proof, battery-efficient, and compatible with multiple banks. Also, mobile connectivity ensures they work even in patchy network zones. That is crucial in tribal belts and remote villages.

Micro ATMs and Financial Inclusion

Micro ATMs are not merely devices but are enablers as well. In fact, providers like PayNearby and Spice Money have deployed thousands of Micro ATMs across India.

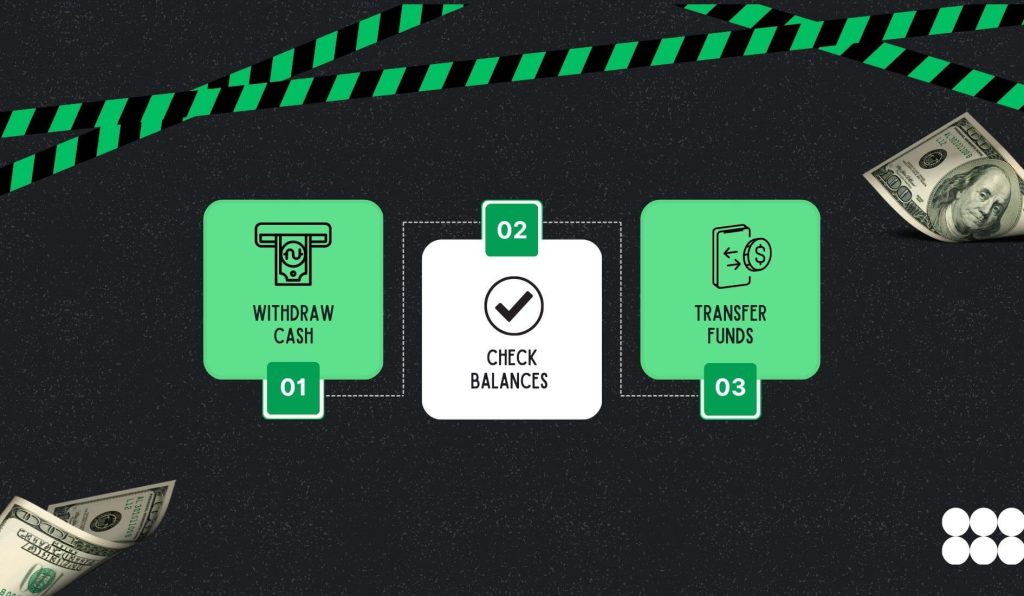

As a result, people in remote areas have the following access:

- Withdraw cash

- Check balances

- Transfer funds (all without stepping into a bank).

It is not merely about convenience but also about dignity. For instance, when a farmer withdraws his MNREGA wages using his fingerprint, that is empowerment. When a grandmother receives her pension without traveling miles, that is real progress.

Basically, Micro ATMs are making digital payments accessible to those who were left out of the fintech revolution.

Business Opportunities with Micro ATMs

It is possible to make money with the help of Micro ATMs. Not only banks, but also local shopkeepers, kirana store owners, and mobile recharge vendors are becoming banking agents.

In fact, these individuals earn commissions on every transaction. These include cash withdrawals, balance inquiries, and fund transfers.

At the outset, this is a win-win. The community gets access to banking while the vendor gets extra income. Meanwhile, banks expand their reach without investing in brick-and-mortar infrastructure. It is grassroots entrepreneurship, powered by technology. The best thing about it is that it is growing.

Major Challenges and Limitations with Micro ATMs

Obviously, it is not all smooth sailing. Sometimes, regulatory hurdles are difficult. Moreover, operators have to comply with KYC norms, transaction limits, and data protection laws. That is a lot for a small vendor to handle.

Meanwhile, technical glitches are common. The following are some examples:

- Devices freeze

- Networks drop

- Biometric mismatches happen.

A recent report paints a worrying picture about India. As per the report, many operators are quitting, and the margins are thin. Also, there is heavy paperwork. In addition, without proper support, sustainability becomes questionable. That is why the model requires many tweaks, better incentives, and simpler compliance.

What Is the Future of Micro ATMs?

In spite of all the major issues with Micro ATMs, the future looks promising. For instance, there has been a surge in deployment, especially with newer models supporting UPI cash withdrawal. That is a big deal.

Hence, it means users will be able to withdraw money easily with the help of a UPI app and a QR code. Also, they will not have to show a card.

Integration with the Aadhaar-enabled payment system is also improving. This has the following benefits:

- Faster authentication

- Better security

- More banks on board

- The tech is evolving.

- Fintech players are investing heavily.

Therefore, expect to see smarter, sleeker, and more reliable Micro ATMs soon.

Micro ATMs Are the Catalysts for Inclusive Growth

Micro ATM is not merely a device but a movement. However, the movement is both quiet and impactful. It is bringing banking to the doorstep of millions. Also, it is turning shopkeepers into bankers. It is making financial inclusion more than just a buzzword.

Of course, there are challenges. However, the potential is massive. Therefore, with the right support, Micro ATMs might become the backbone of rural banking. Although they are not perfect, they are surely necessary and are here to stay.

Frequently Asked Questions (FAQs)

The following are some of the most common questions you might come across regarding the role of Micro ATMs in financial inclusion:

A micro ATM is a portable device that allows users to perform basic banking transactions. These include the following:

• Cash withdrawal

• Balance inquiry

• Fund transfer

Hence, it is really effective in remote areas where traditional banking infrastructure is lacking.

In general, Micro ATMs operate through biometric authentication or debit card verification. Basically, users authenticate through Aadhaar or fingerprints. Also, transactions are processed via secure banking APIs. Essentially, the device connects to the bank’s server with the help of mobile data or Wi-Fi.

Typically, local vendors, shopkeepers, or individuals registered as business correspondents with banks or fintech companies operate micro ATMs. However, they have to undergo basic training. Also, they are authorized to handle transactions on behalf of banks.

The following are some of the major services of a Micro ATM:

• Cash withdrawals

• Checking account balances

• Transfer funds

• Pay bills.

Meanwhile, some advanced models also support UPI cash withdrawal and mini statement generation.

Of course, Micro ATMs are secure. They work with biometric authentication, encrypted data transmission, and secure banking protocols. In addition to that, Aadhaar-based verification adds an extra layer of security. Hence, the transactions are safer and more reliable.