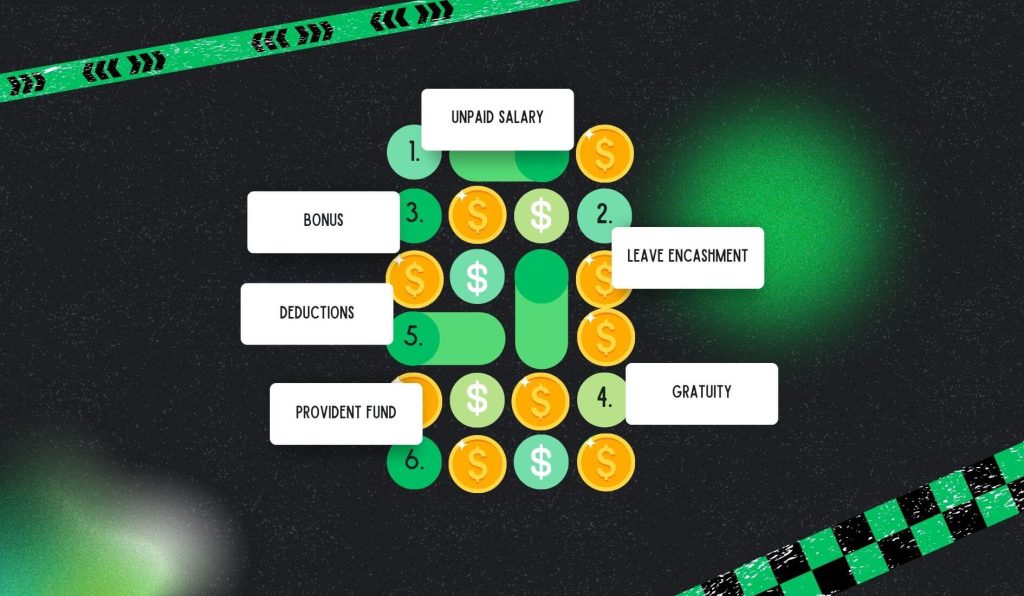

- Components of Final Pay Computation

- 1. Unpaid Salary

- 2. Leave Encashment

- 3. Bonus

- 4. Gratuity

- 5. Provident Fund (PF)

- 6. Deductions

- Step-by-Step Guide for Final Pay Computation

- Legal and Policy Considerations for Final Pay Computation

- 1. Payment Timelines

- 2. Employer Obligations

- 3. Employee Rights

- Tools and Resources for Final Pay Computation

- Calculate Your Final Pay Now!

- Frequently Asked Questions

Final Pay Computation for Employees: Key Points to Know

Final pay computation is not merely a number on a payslip. Rather, it is the last handshake between employer and employee and a financial wrap-up that closes the loop. When someone exits a company, voluntarily or otherwise, this process ensures they receive what the company owes them.

In India, the Payment of Wages Act (1936) and the Payment of Gratuity Act (1972) govern this process. These are not merely bureaucratic formalities. Rather, they are legal safeguards. Basically, they protect workers from delays, deductions, and disputes.

Unfortunately, many employees do not fully understand what goes into this final calculation. That is where things get messy.

Components of Final Pay Computation

1. Unpaid Salary

Let us start with the basics. If you worked 12 days in your last month, you should be paid for those 12 days. Not so simple! In fact, companies mostly calculate this with the help of a 30-day month standard.

So, the formula looks like this:

(Monthly Salary / 26) x Number of Days Worked

In this case, if your monthly salary is ₹60,000 and you work 12 days, you get ₹24,000. But this assumes no deductions, no disputes, and no delays. In reality, things are more complicated.

2. Leave Encashment

When it comes to unused earned leave, it is not just wasted time. Rather, they are money. In fact, if you have 15 days of leave left, and your company allows encashment, that is a payout.

The following formula illustrates leave encashment:

(Basic Salary + Dearness Allowance) ÷ 30 × Number of Unused Leave Days

This is where leave encashment comes in. Although it is taxable, it is helpful at the same time. Moreover, it makes a big difference in your final pay.

3. Bonus

This is where things might get tricky. In general, bonus eligibility depends on the following aspects of yours:

- Contract

- Performance

- The company’s policies.

If a bonus was declared but not paid, it should be included. But if it is discretionary or performance-linked, it might not be.

Basically, the Payment of Bonus Act (1965) states that employees earning below ₹21,000/month are entitled to a minimum bonus. But above that, it is a grey zone.

4. Gratuity

This one is more formulaic. For instance, if you have completed five years, you are eligible. Basically, the formula for gratuity for employees covered under the Payment of Gratuity Act is:

Last Drawn Salary x (15/26) x Number of Years of Service

However, to calculate the gratuity for employees not covered under the Payment of Gratuity Act, use this formula:

Last Drawn Salary x (15/30) x Number of Years of Service

Hence, if your last salary was ₹50,000 and you worked 6 years, you get ₹1,73,077. That is your gratuity calculation. Moreover, it is tax-free up to ₹20 lakhs (only if your employer follows the law).

5. Provident Fund (PF)

Usually, provident fund settlement is straightforward. At the outset, it includes your contributions and the employer’s share. These are transferred or withdrawn. However, delays happen, especially if your UAN is not linked properly. This also happens if your exit date is not updated.

Primarily, EPFO rules govern PF. However, it is your money. Therefore, do not let it slip through the cracks.

6. Deductions

At this stage, things might get murky. In this case, the following aspects might eat up your final pay:

- Tax deductions

- Loan recoveries

- Notice period shortfalls

In fact, some companies even deduct for lost assets or training costs. Meanwhile, others deduct for unserved notice. Hence, make sure you check your contract. Moreover, try to ask for a breakup as transparency matters.

Step-by-Step Guide for Final Pay Computation

If you want to calculate your final pay, follow the steps below:

- Start by gathering documents. These include your last payslip, leave records, and tax forms. Make sure not to rely too much on memory.

- Now, calculate your unpaid salary.

- Then calculate your leave encashment using the 26-day divisor (This is standard).

- Check your eligibility for a bonus. If you are not sure, ask HR. Try not to assume.

- Calculate your gratuity.

- After that, calculate your PF dues (verify with EPFO). Also, use your UAN (Universal Account Number).

- To know about deductions, get a detailed list. However, do not accept vague numbers.

Legal and Policy Considerations for Final Pay Computation

The following are some legal and policy factors you must know when you compute your final pay:

1. Payment Timelines

As per the Payment of Wages Act, your company must pay your wages within two working days of exit. However, in practice, most companies take 30–45 days (That is the norm).

Although not ideal, it is accepted. However, if it stretches beyond that, you have the following options:

- Labor commissioner

- Legal notice

- Even the court.

2. Employer Obligations

Obviously, legal obligations bind employers. Hence, they must process final pay accurately, timely, and transparently. However, failure to do so can lead to penalties. And reputational damage. Especially in today’s talent-driven market.

3. Employee Rights

The law provides employees with rights. Hence, you will be able to dispute your final pay. Also, you have the option to demand clarity. Moreover, you might choose to escalate.

In general, employee rights include access to payslips, breakup of dues, and legal recourse. Therefore, do not hesitate to use them.

Tools and Resources for Final Pay Computation

Of course, there is help out there. Hence, you do not have to do this manually.

- Try utilizing online calculators like Zimyo’s Final Pay Calculator. All you have to do is plug in your numbers and get an estimate.

- Make the most of Templates like Excel sheets in downloadable formats. These are quite handy for manual calculations.

- Also, go for professional assistance from HR consultants and legal advisors. If things get more complicated, reaching out to them makes sense.

Calculate Your Final Pay Now!

Final pay computation is not just math. Rather, it is closure, accountability, and respect. In fact, every component matters. These include everything from unpaid salary to PF and from gratuity to deductions. Also, every rupee counts.

Hence, work with tools like a final pay calculator. Also, understand your rights, and do not settle for less. This is because when you leave a job, you deserve a clean break (both financially and legally).

Frequently Asked Questions

The following are some of the most common questions you will come across regarding final pay computation:

The following are the major components of the final pay:

• Unpaid salary

• Leave encashment

• Bonuses

• Gratuity

• PF

• Other dues.

The following are the major deductions you might face from your final pay:

• Tax

• Loans

• Notice period shortfall

• Asset recovery

Legally, it takes two days to receive your final pay after resignation. However, in practice, it typically takes 30–45 days.

If bonuses are declared and eligible, they must be included in the final pay.

Absolutely! If you want to dispute your final pay calculation, you must approach HR, the labor commissioner, or file a legal claim.