How To Calculate Opportunity Cost? And What Is Its Use?

While going through a book of economics, you may or may not have gone through the term opportunity cost. Before learning how to calculate opportunity cost, it is vital to understand with precision what an opportunity cost is and how it operates.

As a part of the microeconomics theory, you may ask, what opportunity cost is?

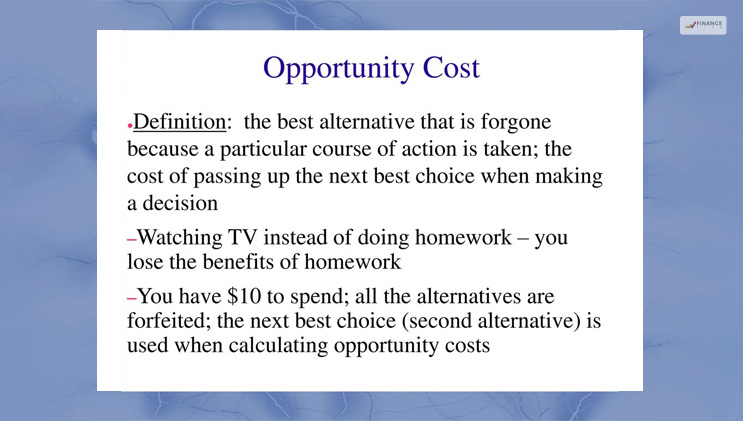

In the simplest terms, opportunity costs represent the potential advantages that a business, an individual, or an investor misses out on while choosing one alternative over the other.

Opportunity costs are unseen in theory and hence one can easily overlook them. But when a business or an individual has a better understanding of the potential missed opportunities while choosing one investment over the other, it helps them in better decision-making.

Points To Remember

- What are opportunity costs: they are the foregone benefits that businesses could have derived from the unchosen option while making an investment.

- To get an accurate evaluation of opportunity costs, one needs to consider all the costs and benefits from every available option and accordingly weigh against one another.

- Individuals and businesses can make profitable decision making if they take the value of opportunity costs into consideration.

- It is neither there in accounting profit nor a part of the external financial reporting; it is strictly an internal cost that is only used for strategic contemplation.

Read More: How To Find Marginal Cost? Why Is It Important For Businesses?

How To Calculate Opportunity Cost?

Formula to calculate Opportunity Cost

Opportunity Cost= FO – CO

where,

FO: returns on the best-forgone option.

CO: returns on the chosen option.

It is a simple formula that shows how to calculate opportunity cost by finding the difference between the returns expected from each option mentioned above.

What Can Opportunity Cost Tell You?

Opportunity costs play an essential part in determining the capital structure of a business. A firm experiences a direct cost while issuing debt and equity capital as it must compensate shareholders and lenders for the investment risks, and yet both options carry an opportunity cost.

For example, you cannot invest funds that for loan payments in stocks or bonds, which could provide potential investment income. Here the company will have to decide if expansion through the leveraging power of debt will generate better profits than expansion through investments.

Businesses try to measure the costs and advantages of issuing debt and stock, which includes all monetary and non-monetary considerations, and arrive at the most favorable balance that minimizes the opportunity cost.

Although evaluating this is a tricky part as the opportunity cost is a forward-looking consideration, which means the actual RoR for either option is unknown at present.

Sunk Cost Vs. Opportunity Cost

While a lot of people may find it confusing to understand the difference between a sunk cost and an opportunity cost and call it the same, there is a straightforward line of difference that separates the both from one another.

Sunk cost is the money that businesses already pay in the past. Whereas an opportunity cost is a potential return that was not earned in the future on investment because of the capital getting invested someplace else.

While planning on how to calculate opportunity cost, you must remember to ignore any previously incurred sunk cost unless there are definite variable outcomes related to those funds.

To simplify it further, if 1,000 shares of company X are bought at $20 each, the sunk cost then stands at $20,000. They pay out the amount to invest, and the only way of getting it back is by liquidating sticks. In comparison, opportunity cost relates to questions about where $20,000 could be used that could have produced better RoR.

Risk And Opportunity Cost

In economic terms, risk is the possibility that the actual and projected returns on an investment are different, and an investor ends up losing some or all of the principal.

The concept of opportunity cost projects the possibility of the returns received on a chosen investment being lesser than the returns of a former acquisition.

The core difference is –

- Risk compares the real performance of an investment compared to its projected performance.

- Opportunity cost compares the performance of one investment against the performance of another.

Example Of An Opportunity Cost

Before making a significant decision, like starting a business or buying a home, it is very typical for you to look through the advantages scrupulously and disadvantages of the financial decisions that you make. But then again, making daily choices with a complete understanding of opportunity cost is not possible.

When individuals feel cautious about a purchase, they will go through the balance in their savings account before they decide to purchase. But they often avoid thinking about what they must give up while making that spending decision.

The critical problem is no one really thinks of the things that could have been done with the money they spend or considers the lost opportunities. Getting takeout for lunch at the office occasionally can be a wise decision, mainly because it gives you a much-needed break from the stress of an office environment.

However, if you keep buying a cheeseburger everyday for the next 25 years, you will experience multiple missed opportunities. Not only will you miss the opportunity of getting sound health, but also, spending an average of $4.50 every day on a budget will add up to $52,000, which is a very achievable 5% RoR.

This was an elementary example, although the key message for a variety of situations stays the same.

It is true that calculating opportunity costs every time you are trying to spend money someplace for your entertainment or necessities can be a killer to joy, but opportunity costs are everywhere, and have their occurrence with every decision you make, no matter how big or small.

Read More: 4 Ways To Afford Car Repair Costs

To Conclude

By now, it must be clear to you what opportunity costs are and how to calculate opportunity costs.

Opportunity costs are nothing complicated. They are the benefits that a business or an individual could have derived if they had chosen one former investment over the other.

Opportunity cost, despite being an economic term, can be put to use in both personal and professional decisions, no matter how big or small.

Read Also: