- What Is Form 4797?

- What Informations Did You Need To Provide While Filling Up Form 4797?

- Who Are Eligible To Fill Up The Form 4797?

- Classification Of Property Under Form 4797

- 1. Depreciation

- 2. Tax Event For Shareholders

- 3. Presence Of Additional Resources

- What Is Form 4797 Used For?

- Frequently Asked Questions (FAQ):

- Final Take Away

What Is IRS Form 4797? When To File 4797?

Do you want to know about form 4797? If yes, read this article carefully to get the required insights. This IRS form 4797 is essential to report the gains for the sales of the exchange property.

This form includes some crucial facts about the sale or the exchange of the business property. It involves generating the rental income and property that you have used for agricultural, industrial, and extractive resources.

You have to follow specific procedures to fill up the form efficiently. However, it can make things work well in your way. You need to know the fundamentals correctly to achieve your objectives effectively.

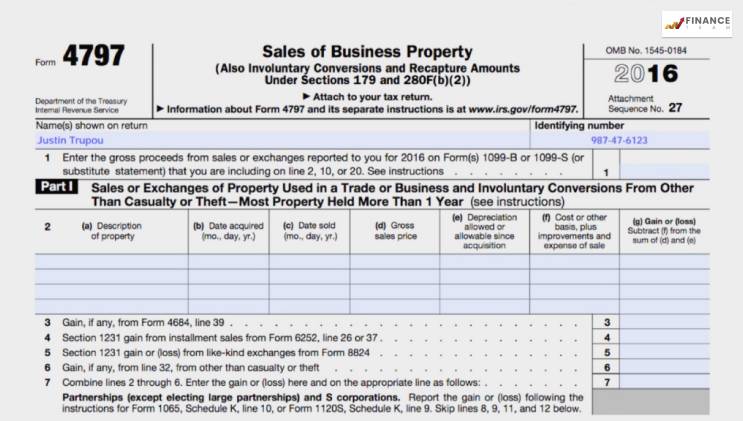

What Is Form 4797?

Form 4797 is a tax form distributed with the help of the internal revenue service. In most cases, the sale of the exchange of the business property includes the property which involves the property that you use for generating rental incomes. These properties are used for extractive, agricultural, and industrial resources.

What Informations Did You Need To Provide While Filling Up Form 4797?

There is undoubtedly crucial information you need to provide while filing form 4797. Some of them are as follows:-

- Purchase date of the property.

- Description of the property.

- Cost of purchase.

- Sale of the transfer date.

- Amount of depreciation

- Gross sale price.

Who Are Eligible To Fill Up The Form 4797?

Business property that is reported on this form includes the property which is purchased to produce the rental income. Taxpayers may make a report on the home which is being used by the business on Form 4797.

It includes the specific parameters which involve the following:-

- Sale of oil

- Export of gas.

- Sale of minerals and geothermal properties.

Classification Of Property Under Form 4797

There are several classifications of the property which fall under form 4797, which you need to fill out. In most cases, possible redemptions include primary residences where partial residences are involved.

In most cases, the expected exemptions include primary residences where you can partially earn the business income. It can be the case for many entrepreneurs, independent contractors, and those who generate their income from home.

1. Depreciation

Based on the classification of the property for which you have to fill up the form 4797, depreciation can form the part of the account as the value of the property gets reduced due to the presence of the taxable income.

2. Tax Event For Shareholders

Depending on the structure of the ownership structure, setup, and investment of the other shareholders, partners and the investors’ experience may also fall into the account.

You can make the consultation with a professional tax advisor to nurture the impact of the sales on the property in the case of any other shareholders and investors.

3. Presence Of Additional Resources

If you have the presence of additional resources which helps in your business to earn money, then you can make use of form 4797. It can make things work well in your way at the right time. But, again, effective planning can make things work well in your way.

Try to achieve your objectives effectively within a stipulated point of time. It can help you to fulfill your objectives in a better manner.

What Is Form 4797 Used For?

Suppose you are transferring or selling the business property, which is used for generating the cash flow. At this point, form 4797 can be used. At this point, personal property must not be listed in the form.

It includes the property, which is listed in sections 1245, 1250, 1252, 1254, and 1255. All these property types are wide-ranging, and it falls under this group.

Frequently Asked Questions (FAQ):

If you have any property which is your home and if you require it for business for that reason, you may need to use that form 4797 for reporting the sale of the property as it forms the part of the business.

Section 1245 assets are depreciable personal property or amortization levels under section 197. Section 1250 assets are real property, and they are not depreciable. It can help things work your way at the correct time if you fill up these forms on time.

There are three methods you have to follow to get form 4797. In this article, you will get to know the procedures correctly. Some of the core procedures are as follows:-

• You can generate form 4797 from the form 4562 screen. In addition, you can make use of the IF Sold section of the screen.

• Use only the data sold on the 4562 screens when you want to complete the 4797 screens.

• You have to enter the data of 4562 for recapturing the data of 179 expenses claimed.

For gaining the subject of ordinary income, you have to enter into the form of 4797 part II Line 10 and Form 8949 column G. It can make things work well in your favor at the correct point in time.

The capital gains are the gains that sell on the business assets, not the capital assets. Therefore, proper implementation of the plans can help you achieve your objectives.

Final Take Away

Hence, if you want to know more about the form IRS Form 4797, the points mentioned above can significantly help you. It can make things work well in your way at the correct time.

Feel free to share your views, comments, and ideas in this regard to know more about it. Proper application of the correct strategy can help you achieve your objectives effectively.

Ensure that you do not make your selection wrong while you want to make things work well in your way at the right point in time. You need to know these facts in detail before filling up this form for your own betterment. At the right point of time, if you can fill up the form, then you can seek its benefits.

Read Also: