- What’s the Current Status of the Slna Stock?

- Fundamental analysis of slna stock

- But why are we interested in slna stock?

- But what about stability?

- Slna Stock Delisted?

- What Now?

- What are the forecasts now?

- Signals and probabilities

- Growth-stock holders, beware!

- Slna stock price prediction

- Slna stocktwits analysis

- Frequently Asked Question(FAQs)!!!:

- The Bottom Line

Slna Stock Delisted? Time to Find Out

Most trending stocks emerge through abstract upmarket phenomena. The same goes for slna stock also.

Selina Hospitality Plc, or SLNA (NASDAQ), is a global brand that provides lifestyle and experience-based hospitality services.

The niche customers of the brand are millennials and Gen Z. Reportedly, they have the highest purchasing power. We may deem Slna stock to be an emerging growth stock.

But that’s not why slna stock is famous right now.

A possible delisting threat now mars the ambitious and carefree growth of Selina. But why?

NASDAQ sent a notice to Selina declaring unacceptable delinquency on their part in filing form 20-F for 2023-24.

But the same may also give the stock some fast-tracked popularity. Hence, it is being converted into prospective value stock.

What’s the Current Status of the Slna Stock?

We can’t state otherwise than signaling a typical but slow-falling trend, signposting the trendy slna stock.

The current developments to the stock are:

- No significant changes in stock price for the last two weeks

- Trading at $0.0300

- The stock may fall ↓ – 57.72% in the upcoming three months

- The stock may move to $0.0239 til the end of the quarter, at best

Many investors are looking for a slna stock short interest in the interim period.

We don’t have any release from the slna stock message board. However, there is a 90% probability that prices will stay between $0.0015 and $0.0239 by the end of the quarter.

Now, that’s a sheer value depreciation that investors cannot undermine.

But there is a catch.

We fathom that slna stock will lose impetus in the coming days.

But if that does not happen and stays upright, its value may be a positive growth.

But there is a catch.

Selina has already declared insolvency.

If the holdings change, the prospects we discuss here might have any significance.

Otherwise, it would all be in vain.

There’s no other major update for slna stock forecast for 2024.

Fundamental analysis of slna stock

Selina seamlessly offers multi-niche services to customers.

Starting from aesthetic accommodations to shared workspaces, Selina has it all.

They transcend niche boundaries to create a significant infrastructure for global travel and working abroad.

Selina has properties listed in some of the most exotic global travel destinations. Thus, the brand draws abundant traffic by its geographical positioning.

We can also portray Selina as a value-generating brand. Their goal of creating a canopy of hospitality services will attract more tourists as the brand grows.

But why are we interested in slna stock?

Our fundamental stock analysis reveals that slna stock has a feeble chance to grow big time for some underlying developments:

- Property acquisition in new strategic locations, skimming more traffic

- Foreboding growth through USPs like community care, green operations, and cultural activities

- Instilling a sense of adventure among tourists, successfully

Selina has grown strategic collaborations with local and global brands. It will pave the way for remote workers and digital nomads to be attracted.

But what about stability?

We know that arching growth is not all that defines the prospect of a brand. Most importantly, Selina declared insolvency. Now, a change in holdings can only save the brand.

You should also know whether it’s a growth or value stock.

Now, Selina has a commendable chance of growth. To top it up, the charts suggest steep revenue growth. Their customer base is also swelling with time.

However, the current stock capital is 0.

What they already have is a unique blend of services listed.

However, as understood from slna stock news delisting remains a threat to frown upon. Their incumbent bankruptcy is another red flag.

However, some of Selina’s overarching prospects may also cover up the threat.

They introduced seamless online booking services recently. At the same time, Selina’s wellness campaigns and recreational activities increased in number and variations.

What’s more intriguing is Selina’s stable financial dashboard.

With all these mighty features, Selina should find it’s place among the prospective stocks of time.

Slna Stock Delisted?

Not yet. But chances are luring.

We know about the notice that SLNA received from NASDAQ due to non-conformance. But is there a remedy to the crisis?

The notice clearly says:

“delay in filing the 2023 20-F serves as an added basis for potentially delisting the Company’s securities from The Nasdaq Stock Exchange”.

If you think that’s all, you are mistaken.

Selina received another letter earlier. It was a staff determination letter from NASDAQ.

The letter marked that the closing value of slna stock was below $0.10 for ten days in a stretch.

In the same vein, NASDAQ’s Listing Rule 5810(c)(3)(A)(iii) proclaims that if a company’s ordinary stocks hit rock bottom and stay that way, there are chances that the stock will be delisted.

Time will tell whether slna delisting will take place.

But Selina is in deep waters.

The company got another letter last year. It clarified that the bid price of Selina’s properties did not recover after a 30-day consecutive low.

Selina’s bid price closed below $1.00 daily for the whole stretch.

What Now?

Seline has time till 3rd September 2024 to make amendments. By then, slna stock’s bid price must go over $1.00 by any means.

What are the forecasts now?

Will Selina’s stock health improve? Will slna stock delisting happen, or will the company’s acute financial performance bring results?

Let’s investigate.

Signals and probabilities

I can see mainly sell signals in real-time. Here, I am talking with both short and long-term investors.

I also request that you avoid Slna stock if you’re building a retirement portfolio.

But you will get a different slna stock forecast from optimists. I’ll tell you why.

A price of $0.0300 to $0.0451 could mean a silver lining for them. For example, the Nxu stock is now faring at a margin above the edge at $0.33. Yet, volumes fell visibly on 15th August. But a good thing is that stock prices remain unchanged.

Growth-stock holders, beware!

Slna stock Nasdaq reviews leave no glimpse of light to invigorate growth investors. A more precise and more prompt explanation may make more sense here.

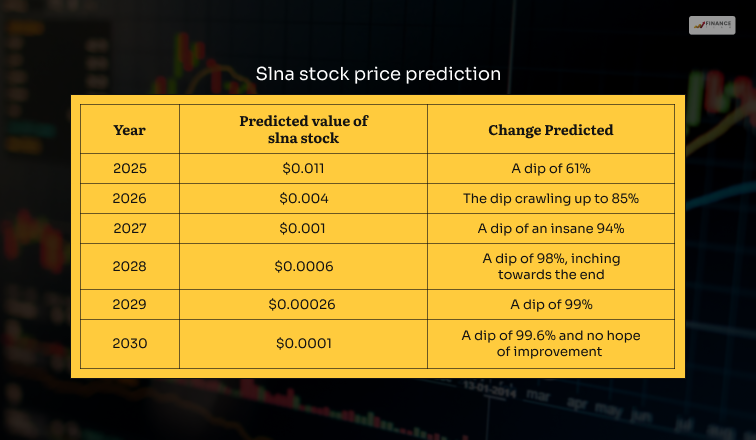

We tracked the average annual growth stats of slna stock over the last decade. Signposting the significant dips throughout, we may forecast a stock opening of $ 0.011606 for 2025.

Similarly, we can also predict the stock values for consecutive years till 2030.

Slna stock price prediction

Here, we assume that the growth trends we have seen over the last ten years won’t change. However, we witnessed an impetus from Selina to uplift revenues and stock values through diverse efforts.

But we certainly don’t know much about financials. What we see are the plans and disclaimers.

If that bears fruit in the end, it is a different context altogether.

Our 2030 predictions are the worst and seem almost surreal. But it’s not a sudden dip in stock values. Instead, it has been a chronic development for the last ten years or so.

We predicted an alarming -99.6% growth upon the current price.

So, the bottom line is I issue an essential “sell alert.” At the same time, I can’t appreciate slna stock as a value-generating long-term stock.

Slna stocktwits analysis

The retail ecosystem that Selina created is falling apart—the niche of digital nomads needed to respond better to their market offerings.

So where does slna stock stand amidst this downfall?

slna stocktwits lists a real-time stock value of $0.0008. Moreover, there is no hopeful slna news today.

I will not post any further SLA stock price targets, as Selina has already filed for insolvency. Their Credit Reports are pathetic. Their stock capital has vanished.

Hopes dimmer to see the owners stating that there are no prospects to save the brand from bankruptcy.

On top of that, NASDAQ would probably delist slna stock.

What about the chances of the slna stock reverse split?

Once, there was a slight chance of a 1:30 reserve stock split. But we know now that the SNA stock split is not happening.

The holding committee thought moving with the insolvency filing would be the best.

Frequently Asked Question(FAQs)!!!:

I answered all queries about slna stock in the article. Yet, many readers keep coming back with common queries like these:

Ans: The average annual stock price target is $4.59. But the reality is estranged from that. The brand is under threat of insolvency and, hence, bankruptcy.

Ans: The faring target is $4.59. However, I won’t be too hopeful here. I don’t consider it to be valuable now.

Ans: The current Selina hostel stock price is $0.0008.

The Bottom Line

The slna stock is a dead stock, without a doubt. In current circumstances, the stock is going nowhere. However, a change in holdings or a desperate attempt by financial institutions to resolve insolvency may change the picture.

What makes me linger with hope is Selina’s magnificent business market. I will make another blog if there is any more significant update on slna stock. But you can always post your queries and comments regarding Selina here.

For More Informative Financial Articles Click Below!!