- What Is A Trust?

- Understanding A Trust

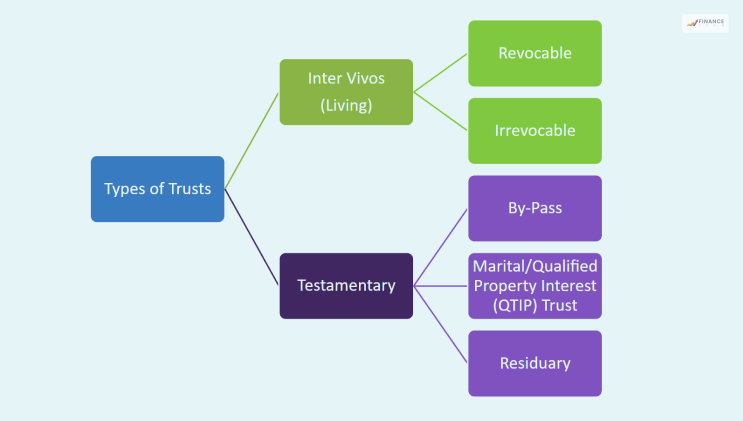

- Types Of Trusts

- Living Or Testamentary

- Revocable Or Irrevocable

- Funded Or Unfunded

- Benefits Of Different Types Of Trusts

- Bypass Probate

- Privacy

- Tax Advantages

- Protect Assets From Creditors

- Controlling Assets

- Children As Beneficiaries

- How To Choose The Right Trust For You?

- Bottom Line

Different Types Of Trusts And Find Out Which Is Right For You?

Have you thought about adding a Trust within your estate plan? A brilliant decision indeed. Let’s Learn About Types of Trusts.

If you are already on it or have a Will already, Trusts will add a layer of security to your family or legacy once you are gone.

If your assets are worth over $160,000, you own a house, and you have dependents, planning on a Trust might just be the best decision you will make, although where to start?

As a starter, the entire concept of Estate planning might be confusing and daunting for you. However, with our help, you can quickly get through the process and feel confident about the choices that you have made.

Without any further delay, let us get started.

What Is A Trust?

A trust is a legal document incorporated with distinct and separate rights, similar to a person or an organization. A Trust comprises two parties- the trustee and the trustor. The trustor hands the trustee the rights to manage or hold the title to property or assets which will benefit the third party, the beneficiary.

Trusts are established to provide legal securities to the trustor’s assets to ensure they are being distributed as per their wishes. Trusts can save you time, reduce paperwork, and may result in deducting estate or inheritance taxes.

Different types of trusts cater to the diverse needs of a trustor, but before deciding on a suitable one for yourself, you will have to understand some of the basic technicalities associated with a Trust.

Understanding A Trust

Settlers are required to curate a Trust. Settlors include an individual along with a lawyer who is the deciding agent on the transfer parts or everything that is associated with an individual’s assets to the trustees.

The rules of a trust will solely depend on the terms which will be initially incorporated by the trustor. In some instances, the possibility of a beneficiary becoming a trustee is available.

For example, in certain jurisdictions, the grantor can be a lifetime beneficiary alongside being a trustee.

The basic necessity of a trust fund is to determine how an individual’s assets or properties are to be distributed while the individual is alive or after death.

Types Of Trusts

Although the types of trust are many, most of them fit into the following categories.

- Living Or Testamentary Trust

- Revocable Or Irrevocable Trust

- Fune Or Unfunded Trust

Now let us get into the details of the different types of trusts and figure out which ones work the best for you.

Living Or Testamentary

A living trust is also known as an inter-vivos trust. It is a written document wherein an individual’s assets are offered as a trust the individual use and benefits them during their entire lifetime.

The name of a trustee is issued while the trust is being created. The trustee will be in charge of dealing with all the affairs of the trust. At the time of the grantor’s death, the trustee will be responsible for transferring the assets to the respective beneficiaries.

The testamentary trust, which is also known as the will trust, highlights how an individual’s assets are nominated after the death of the grantor.

Revocable Or Irrevocable

Revocable trusts can either be changed or terminated by the trustor during his lifetime. However, an irrevocable trust, as the name suggests, can not be altered or terminated once it is established.

A living trust can be both revocable and irrevocable. However, testamentary trusts are generally considered irrevocable. But, the grantor has the liberty to make it revocable as long as he is alive.

Funded Or Unfunded

The trustor can put his lifetime assets into the funded trusts, whereas unfunded trusts contain only an agreement and no funding.

An unfunded trust can be converted into a trust fund upon the death of the grantor or can remain unfunded.

Securing proper funding is essential, as an unfunded trust will expose the assets to many of the dangers that a trust was initially designed to avoid.

Benefits Of Different Types Of Trusts

The different trust fund types may have their own benefits, which cater to the needs of every individual. However, regardless of the forms of trusts, there are countable benefits similar to all types of trusts available.

Bypass Probate

Assets that are willing to be beneficiaries are required to go through probate- a legal process that is not only time-consuming but also expensive. Avoiding probate helps in saving time and money for beneficiaries alongside protecting the privacy of the family.

Privacy

Trusts are not public records; hence they contribute majorly to protecting your privacy.

Tax Advantages

There are certain specific types of trusts that allow the assets to get transferred out of the estate while effectively reducing estate and gift taxes.

Protect Assets From Creditors

Equivalent to the tax benefit, trusts change ownership of the assets hence restricting the access of the creditors or even judgments from them.

Controlling Assets

The grantor is to mention who receives how much of the assets upon his death. Hence, the grantor gets to control the flow of his assets after his death.

Children As Beneficiaries

You can use a trust to confirm your children as the beneficiaries of your insurance policies or other assets.

How To Choose The Right Trust For You?

There is no particular way to decide which trust is the best suited for you. It is entirely your decision and your needs that you want to aid with the help of a trust. There are many different types of trusts that you have the liberty to choose from. There are different types of family trusts, special needs trusts, funded trusts, and so on, which all have different purposes and can accordingly cater to your particular needs.

I would suggest that you first gain some knowledge of trust. Understanding your and your family’s needs before setting up a trust is crucial. Do not unthinkingly make any decision that will later cause serious trouble for your family.

Bottom Line

Trusts are complex to understand. The wide range of the types of trusts adds more to the already existing complexity.

Before making a trust fund, consult an attorney, and take the help of one while making a trust fund as well.

Explore More Finance With Us: