- Fact Check Before Investing in Variable Life Insurance

- How Does Variable Life Insurance Work?

- Variable universal life insurance

- But how much does variable universal life insurance cost?

- Follow these niches to understand the cost

- Personal Characteristics

- Fees You Want to Pay

- Extra Features

- These are the Best variable universal life insurance policy

- Ameriprise variable universal life insurance

- Northwestern Mutual Variable Life insurance

- John Hancock Flexible Variable Life Insurance

- Be wary of these disadvantages of variable life insurance (risks)

- Pick your variable life insurance wisely

Variable Life Insurance | Best LIFETIME Returns but Risky | What Do Experts Think??

In the US, 172.5 million people have a life cover. But 41% of the adults feel they are not adequately covered. So, they need variable life insurance. It will provide them with assured coverage. At the same time, they can enjoy the investment component of this life insurance scheme.

Like whole life insurance, there is death coverage with variable life insurance, too. However, the most significant advantage of this insurance scheme is something else. The cash value of the scheme is reinstated into mutual funds to multiply the returns.

The best variable universal life insurance companies offer reasonable death coverage. However, it also varies depending on the monthly premium you pay. It also depends on how your funds perform in the mutual funds market.

Most people may feel the investment angle makes variable insurance the most investible option. However, there are some facts you must remember before signing up for it.

Fact Check Before Investing in Variable Life Insurance

Even the best variable universal life insurance might not revert the best returns. The return depends on the following factors:

- You can earn more with a variable policy than with whole life insurance. But check the current stock index before investing.

- If the market performs poorly, you may be on the losing end.

- You must pay fixed premiums like term life insurance. So, choose your scheme wisely.

- You will get assured death benefits in most cases.

- Variable life insurance allows you to borrow funds against the cash value you’ve gained.

- But that would affect the final death cover. However, you can pay back the sum borrowed and erase any effect.

- Be ready to count extra taxes and charges if you are not paying your premiums or abruptly borrowing funds.

How Does Variable Life Insurance Work?

Insurance providers invest your premiums in other mutual funds. Most indexed funds earn good dividends. However, there is no assurance that there will be a positive gain. You may lose some money, too.

However, experts say that you can gain a high cut above the sum you invest as premiums in the long run. But can you control your investments? Yes, you can.

All policyholders can choose how they want to allocate their funds to multiple investment programs. You may also invest your premiums in individual mutual funds rather than indexed funds.

The best variable universal life insurance policy lets you invest a part of the cash value in fixed-rate funds. It’s a way to ensure you gain a specific cut above the premiums.

Variable universal life insurance

One of the most popular VL policies is the variable universal life insurance. It combines the best values from universal and variable insurance policies. First, it offers lifelong protection for all your contingencies. Secondly, it also provides flexible premiums. You can access the cash value until you are alive.

But how much does variable universal life insurance cost?

You may have to pay a cut above the standard rates to enjoy benefits. Here’s a classification to help you:

Cost vs Cash Value: Is variable life insurance worth it??

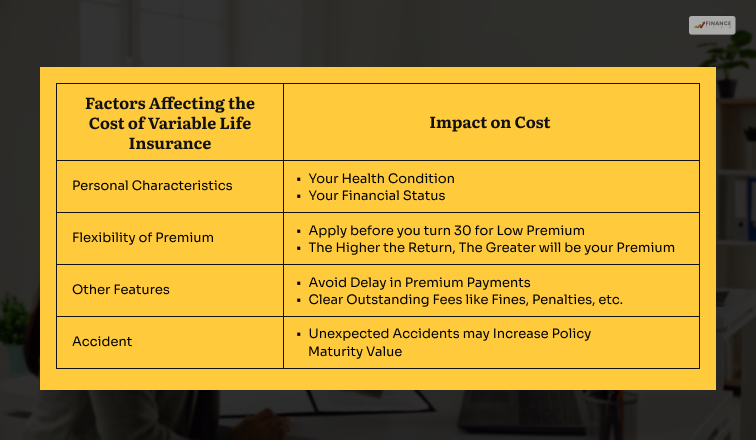

The cost of variable life insurance might vary from one person to another. However, you can trace the cost variance. That’s why experts say it is the best life insurance in usa. It depends on these factors:

- Which life insurance company you choose

- What are your investment objectives

- Do you manage your finances well

Follow these niches to understand the cost

How can you accommodate the above factors while determining your costs for a variable life insurance? One of the benefits of variable universal life insurance is the variable costing component. But you can keep your costs low if you take care of these areas:

Personal Characteristics

Your health condition is the prime determinator of the insurance premium payable. If you are a non-smoker, you can quickly get an insurance value of $250000. But smokers of the same age will be eligible for a value somewhere between $100000 to $150000.

The cut below is approximately $100000 to $150000. So, you can understand how much your health matters. The same happens due to age differences.

A person aged 30 years has more chances of getting higher “end-of-policy” returns. A person over 45 has far less chance of getting high returns. The return value keeps depreciating with further age.

Fees You Want to Pay

Often, we cannot afford high monthly premiums. But flexible schemes like variable life insurance make our lives easier. We can also enjoy the scheme at a low premium. If you want to enjoy $250000 against a low monthly premium, you must pick and apply for your policy early.

Let’s take an example to understand. A person aged 30 can afford a $100 monthly premium on his monthly salary. However, he expects a high return (approx- $250000). Is that possible- YES!

However, the same cannot be said if the person is already 45 or older. He may opt for the same scheme. But he will have less leverage. The average premium payable at this age for a proportionately high coverage value would be $220.

If the same person wants to pay $100, he will enjoy a much lesser return. Some providers don’t allow recipients to pay less than a $220 premium at 45+ years of age.

Extra Features

You cannot secure a low monthly premium, even if you follow all these! You need to take care of a few more subtle factors.

- Have you experienced any lapses in premium payments? If so, it may badly affect your final return. Unless you compensate for the pending premium and extra penalties applicable to the bounce.

- If you have a disability, your premium charges will be higher. Or any other vital life condition like high BP or chronic diabetes, for that matter.

| Pro Tip: Try to convince your insurer that your disability is not life-threatening in any way. You may produce conducive medical reports or produce doctor’s certificates in that regard. |

- An accidental death is always despicable. But it may benefit your dependents. In any such case, your nominees receive much more than the standard death cover amount receivable.

These are the Best variable universal life insurance policy

A lot of vendors are selling variable life insurance today. So, how can you choose which is best for you? Firstly, check for the ones that have no hidden costs. Secondly, pick the ones that offer the best returns at the lowest premiums. Lastly, check consumer ratings of your chosen policies and vendors.

I followed the same provisions and found these:

Ameriprise variable universal life insurance

Ameriprise offers some of the most significant benefits I was looking for. Firstly, I can enjoy their tax-deferred death cover. Secondly, some local agents can help with any scheme in person.

Since 2023, Ameriprise has not released any online quotes. It may be, however, a concern for users.

- Premium expense rate- 4%

- Plan Validity- Lifetime

- Death Cover- Yes

Northwestern Mutual Variable Life insurance

Northwestern Mutual has substantial financial strength. So, all users will likely get paid. I checked their site last weekend. You will be amazed to see clear policy illustrations and cost breakdowns.

NWM also has A++ and AAA ratings from various listing and reporting sites like NerdWallet and US News.

- Policy cost/per month- $20

- Plan Validity- Lifetime

- Death Cover- Yes

John Hancock Flexible Variable Life Insurance

I prefer John Hancock as they don’t directly invest my money in stocks or equity. However, you will find your investment going into annuities and indexed funds. Henceforth, your funds are safe. It also improves your chances of return.

Users also enjoy the options like switching among multiple allocation options. As your needs vary with time, JH can accommodate accordingly.

- Starting annual rate- $172.5

- Plan Validity- Lifetime

- Death Cover- Yes

Be wary of these disadvantages of variable life insurance (risks)

I support all who favor variable life insurance over whole life insurance. In fact, I also enjoy the flexibility that it offers. However, there are some loopholes that users may overlook.

In 2024, many users could not maintain enough cash balance in their variable policy accounts. As a result, their policies got canceled, and they had to pay heavy fines.

| Please Note- A lapse is a termination that deprives the user of all return benefits. So, pay the minimum stability premium to keep your policies alive. |

Secondly, I dread the investment risk associated with the variable schemes. You can select your favored funds where you want your cash value to circulate. But you must bear the consequences if your selected stocks fail. I cannot diminish my concern as such risks exist in full swing.

Lastly, there should be more clarity in the prospectus that signposts the amount I paid to purchase the insurance. There can also be more clarity about the fees that I must pay to get standard returns.

Pick your variable life insurance wisely

Most people don’t have clarity about what a variable life insurance policy is. For them- it is a permanent insurance policy offering flexible premium submission.

What are the two components of variable life insurance? The most significant one is its death cover. However, the cash value that comes with it is also beneficial. You can use it to manage real-time crises.

However, all users should be aware of the TWO BIG risks I mentioned. If you can tackle the risks, then variable insurance is suitable for you. Follow the unique tricks and tips I shared to handle the risks well.

Good Luck with your POLICY!!

For More Informative Financial Article Click Below!!