- Traditional Scope of Financial Management

- 1. Investment Decisions

- 2. Financing Decisions

- 3. Dividend Decisions

- Modern Scope of Financial Management

- 1. Technology Integration

- 2. Globalisation and Compliance

- 3. Sustainability and ESG

- Traditional vs. Modern Scope of Financial Management

- Strategic Role in Business Growth

- 1. Linking Finance to Corporate Strategy

- 2. Risk Management Beyond Basics

- Behavioural and Ethical Considerations

- 1. Behavioural Finance

- 2. Ethics and Governance

- Skills for the Future Financial Manager

- The Human Factor in Finance

- Prepare for the Future of Finance!

- Frequently Asked Questions (FAQs)

- 1. Why Is Financial Management More Strategic Today?

- 2. How Does Globalisation Impact Financial Management?

Scope of Financial Management in the Modern Era: A New Outlook!

Financial management has always been the backbone of business decision-making. However, the game has changed. In fact, the old-school approach of merely balancing books and managing cash flow no longer works.

Today, the scope of financial management stretches far beyond traditional boundaries. It is not just about numbers. Rather, it is about strategy, tech, and even human behaviour. Hence, it is important to know why financial management requires a fresh perspective.

Traditional Scope of Financial Management

The following are some of the major aspects of financial management:

1. Investment Decisions

Back in the day, capital budgeting was a big deal. In fact, companies obsessed over which projects deserved funding. Also, financial managers calculated long-term investments with precision using NPV, IRR, and payback periods.

Essentially, it was about maximising the shareholders’ wealth. However, the process was rigid. Also, it failed to account for factors like market volatility and behavioural biases.

2. Financing Decisions

The next question was where to get the money. Whether it was debt or equity, the cost of capital ruled the conversation. Meanwhile, CFOs focused on minimising the weighted average cost of capital (WACC).

In those cases, the playground was banks, bonds, and equity markets. As a result, financial management was simple, structured, and predictable.

3. Dividend Decisions

Profit distribution strategies were straightforward. In this case, the question was whether to retain earnings or pay dividends. Basically, the debate was mostly about signalling and sending the right message to investors.

In fact, stability mattered more than flexibility. Moreover, companies rarely thought about reinvesting in innovation.

Modern Scope of Financial Management

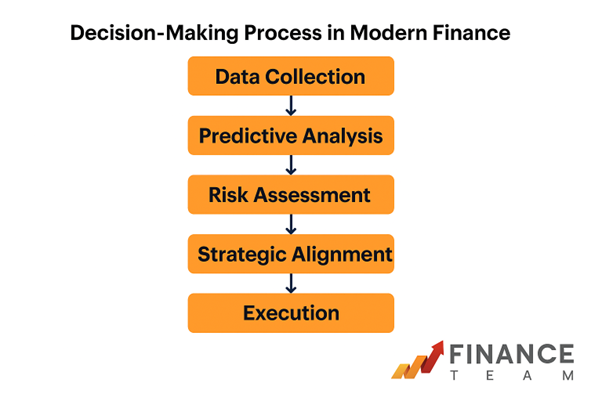

The modern era flipped the script. Now, finance is no longer isolated. Rather, it is integrated with technology, sustainability, and global compliance. In fact, the scope of financial management now includes dimensions that people did not know even two decades ago.

(Source: Author)

1. Technology Integration

The following are the factors that are transforming financial workflows:

- AI-based analytics

- Automation

- ERP systems

For instance, predictive models forecast risks before they hit. Meanwhile, robotic process automation (RPA) handles repetitive tasks. This way, it frees managers to focus on strategic thinking. Moreover, even finance dashboards now look like data science labs.

2. Globalisation and Compliance

When it comes to money transfer, borders no longer exist. In fact, the following are some of the major complexities of international finance:

- Currency risk

- Tax complexities

- Compliance headaches

- IFRS and GAAP standards demand transparency across geographies.

Hence, companies have to comply with multiple regulations. At the same time, they have to manage global liquidity.

3. Sustainability and ESG

Now, finance is no longer about mere profit. In fact, Environmental, Social, and Governance (ESG) metrics are part of valuation models. Also, investors want green portfolios. CFOs now calculate carbon footprints alongside ROI. Hence, ethical finance is not optional, but a mandate.

Traditional vs. Modern Scope of Financial Management

The following table shows the difference between traditional and modern financial management:

| Aspect | Traditional Scope | Modern Scope |

|---|---|---|

| Decision Focus | Investment, Financing, Dividend | Tech, ESG, Global Compliance |

| Tools Used | Ratio Analysis, NPV | AI, ERP, Predictive Analytics |

| Risk Management | Basic Hedging | Cybersecurity, Scenario Planning |

| Strategic Role | Supportive | Core Driver of Growth |

Strategic Role in Business Growth

Finance has become a growth enabler, not just a scorekeeper.

1. Linking Finance to Corporate Strategy

At the outset, finance drives everything from mergers and acquisitions to expansion plans and innovation funding. Hence, financial planning and corporate vision must strategically align. Also, companies work with scenario modelling to test growth strategies before committing capital.

2. Risk Management Beyond Basics

As of now, hedging and derivatives are old news. Now, firms deploy advanced scenario planning and stress testing. Cybersecurity risks, geopolitical shocks, and supply chain disruptions are part of financial risk frameworks. This shows that it is a whole new battlefield.

Behavioural and Ethical Considerations

Numbers do not tell the whole story anymore. The following are some of the major behavioural and ethical factors you must be aware of:

1. Behavioural Finance

Human psychology is the biggest factor that affects financial decisions. In fact, investment patterns are influenced by overconfidence, herd behaviour, and loss aversion. Therefore, financial managers now study behavioural cues to design better strategies.

2. Ethics and Governance

When it comes to finance, transparency is non-negotiable. Also, stakeholders demand accountability. Hence, ethical lapses might destroy brand equity overnight.

Therefore, governance frameworks are necessary to ensure compliance and trust. Moreover, finance leaders are custodians of integrity as much as they are of capital.

Skills for the Future Financial Manager

The future CFO is not just a number cruncher. They’re a strategist, a tech enthusiast, and a behavioural analyst. Data analytics, compliance knowledge, and tech proficiency are now baseline skills. Understanding the evolving scope of financial management is career-critical. Add soft skills like adaptability and ethical judgment, and you’ve got the modern finance leader.

The Human Factor in Finance

Interestingly, finance now intersects with HR. In fact, employee engagement platforms influence retention and productivity. This, in turn, indirectly affects financial performance.

Moreover, pulse surveys help gauge workforce morale. This helps to perform cost-benefit analyses for talent strategies. Now, finance is no longer merely about capital, but also about human capital.

Prepare for the Future of Finance!

Earlier, the scope of financial management was narrow and number-centric. Now, it has become multidimensional and strategic. Moreover, it is tech-based, globally connected, and ethically grounded.

Hence, if you want to grow with your business, adapt to this new outlook. Stay informed, agile, and prepared for the future of finance.

Frequently Asked Questions (FAQs)

The following are some questions you might find common on the internet:

1. Why Is Financial Management More Strategic Today?

Presently, financial management is no longer about balancing books. Rather, it is about aligning finance with corporate strategy, tech adoption, and global compliance. This helps to drive growth and resilience.

2. How Does Globalisation Impact Financial Management?

Primarily, globalisation adds complexity:

- Currency risks

- Tax regulations

- Compliance with IFRS or GAAP across borders.

Finance teams now manage global liquidity and cross-border investments.

3. Why Do Behavioural Factors Matter in Finance?

Now, behavioural factors matter because numbers do not operate in isolation. In fact, human biases like overconfidence and herd behaviour influence decision-making. So, managers factor psychology into their financial strategies.

4. What Skills Define the Future Financial Manager?

Future financial managers must have the following skills:

- Data analytics

- Tech proficiency

- Compliance knowledge

- Adaptability and ethical judgment.

Moreover, finance leaders must think beyond numbers and embrace strategic and tech-driven roles.