- Main Takeaways

- Guaranteed universal life insurance benefits

- Understand the meaning of universal life insurance with an example

- Universal life insurance vs term Life insurance

- Index universal life insurance policy

- Unique Features

- Variable universal life insurance

- What is the best universal life insurance?

- Survivorship universal life insurance

- Where can I use this policy?

- Best guaranteed universal life insurance for seniors

- What are the disadvantages of universal life insurance?

- Frequently Asked Question!!! (FAQs):

- Time to decide!

Take Charge of Your Own Life with Universal Life Insurance: Best CASH Returns Ever?

Need lifelong coverage? Oh! Cash Value too? Universal Life Insurance is the best solution for you. It gives you all. You also get flexible premium payment options.

So, how does it differ from whole life insurance? Well, there are two areas. Firstly, Universal Life Insurance is cheaper. Secondly, you can increase or decrease your premium value with Univeral Life Insurance.

However, whole life insurance does not offer such benefits. Yet there are some loopholes that you must know. Don’t delay premium payments. It can cause your policy to lapse. The same can also happen if the investments don’t perform as expected.

Main Takeaways

We know Universal Life Insurance comes with the lifelong cover advantage. But I also found these unique angles while comparing whole life and universal life insurance:

- You can withdraw money more freely from your cash value

- You can also borrow cash from the same source

- However, the risks of Universal Life Insurance are higher

- Still, Universal Life Insurance is more flexible than term and whole life insurance in connection with premium payments

- You can decide and fluctuate your monthly premium value as per your financial leverage

- In fact, you can negotiate your death benefit too.

**Facts you should know: You can adjust your Universal Life Insurance scheme. You can do that if you need more cash value and want to compensate your prompt fiscal needs with it. However, your death cover will be lower. And vice versa.

Guaranteed universal life insurance benefits

Not only lifetime protection. Universal Life Insurance has benefits distinct from whole life or other insurance schemes. If you don’t know these benefits, you can’t choose the best:

Understand the meaning of universal life insurance with an example

We will consider you to be an average male aged 30 years. According to my calculations, universal life insurance of $1 million is adequate for your needs. In that case, your monthly premium will be $284.

The premium helps you boost your insurance coverage. Meanwhile, it also adds to your cash value. For instance, $241 out of $284 will go towards your insurance cover. The rest ($43) will improve your cash value balance.

At this time point, the cash balance will be $10000. You can then borrow against the amount. You can also withdraw money from the fund directly. You may redirect money from your cash value towards your monthly insurance premium payments.

Universal life insurance vs term Life insurance

Term life insurance doesn’t offer several benefits that UL gives to its users. Meanwhile, term life also has a fixed validity period. Beyond that, the insurance becomes invalid.

However, the insurance premiums for UL are way more expensive than those for term life. Firstly, charges are higher, as UL offers lifetime coverage. Secondly, a significant part of the UL premium goes toward its cash value.

The cash value is a separate fund that Term Life does not offer. However, the death cover of UL may depreciate with time. However, the converge return of Term life is fixed.

Index universal life insurance policy

An indexed Universal Life Insurance Policy offers better returns than a standard UL policy. But how? The main difference lies in the cash value of the two funds. Firstly, IUL offers returns based on stock index returns. In comparison, normal UL offers returns from non-equity-based investments.

That’s why IUL can offer higher returns. However, stock indices may go down, too. In that case, your cash value will be impacted as well. The national life group indexed universal life insurance among the mainstream policy issuers.

Unique Features

The national life group indexed universal life insurance has a “floor” policy. It ensures that users get a suitable minimum interest rate even if the index is negative.

Variable universal life insurance

Variable life insurance is a more flexible scheme. You can now enjoy greater returns through it. All you need to do is reinvest your cash component. It is one of the most unique offers that rarely any other life insurance offers.

It comes with a sub-account. Here, you can invest your cash value in whole or in parts.

What is the best universal life insurance?

All universal life insurance companies offer similar benefits. However, the following schemes stand out for their special offers and remarkable flexibilities:

Survivorship universal life insurance

Aka second-to-die insurance, this policy covers the death of two people. But the Survivorship policy pays out only when both people die. On one hand, it costs less than two policies for two separate individuals. On the other hand, the policy’s death returns are also higher than basic universal life insurance policies.

Where can I use this policy?

You can now use Survivorship universal life insurance for several occasions. Often, some people want to leave their legacies behind. For example, they may wish to donate or support the next generation to grow. Let’s check out some of the best use cases of Survivorship:

- You can save a fortune by donating it to a charity after your demise.

- You can also support your disabled child by creating a Special Needs trust as a part of the Survivorship scheme. The fund will ensure that the child receives lifelong care.

- You can also create a Survivorship scheme to support family members that are not part of your business.

- You can also participate in smart estate planning by passing on tax-free income to heirs. They can later use the funds to clear off mandatory estate taxes.

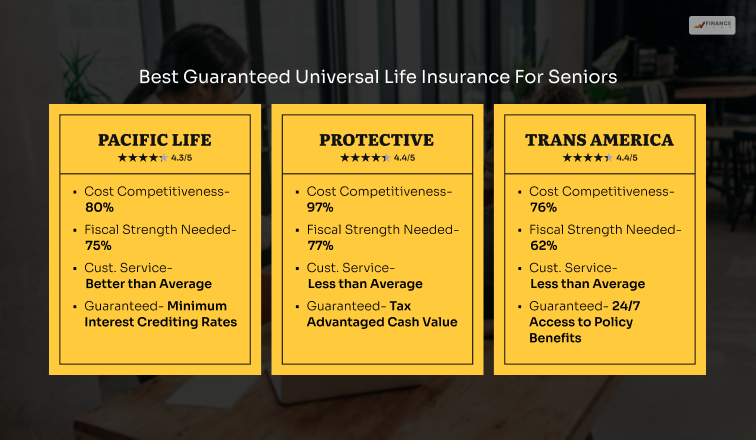

Best guaranteed universal life insurance for seniors

Affordable UL schemes that serve the purpose, too, are rare. On top of that, seniors need more accessible schemes that cost less, too. They have fixed incomes. So, they cannot accommodate surviving dependents if their insurance coverage shrinks.

That’s why the following schemes are best for them:

What are the disadvantages of universal life insurance?

The universal life insurance scheme is the most flexible of all. However, it has some demerits you cannot ignore. For instance, policy loans and frequent withdrawals can deplete your final insurance value.

If you have poor premium payment rates, your policy may also lapse. In comparison, whole life insurance offers a more assured lifetime return. The cash value of UL is also higher.

Frequently Asked Question!!! (FAQs):

Many people express concerns while trying to understand the best life insurance in usa. Hence, I answered the most common and recurring queries here.

Ans: It is a form of permanent life insurance. Firstly, it provides lifetime protection. Secondly, it offers cash value to users. However, monthly premiums are flexible. Hence, UL- Flexible Life Insurance.

Ans: You continuously monitor your cash value. Otherwise, the policy will become redundant. This implies you must pay a hefty sum to bring a redundant policy back on track.

Ans: There are many benefits of universal life insurance. However, the chances of returning are higher with whole life insurance.

Time to decide!

Universal life insurance offers the most diverse and effective investment savings option. It offers flexible loan options, too. And we must not forget its flexible premiums. You can increase or decrease your premium limits within a range. Hence, you can continue the scheme even when your finances are down.

I prefer UL because of its tax-deferred schemes. The whole cash value is tax-free. However, the loan taken is not tax-free. If you don’t repay promptly, loans will accrue and accumulate.

The bottom line is that users must buy UL tactfully:

- Learn all the parameters and conditions applicable.

- Compare UL with whole life insurance.

- Decide what’s best for you.

If you have any other queries, comment below!

For More Informative Financial Article Click Below!!