- What Is BMO Harris Express Loan Pay?

- Why Should You Use BMO Harris Loan Pay?

- 1. Quick Transactions

- 2. High Levels Of Security

- 3. Ease Of Use

- 4. Cost Efficiency

- 5. Saves Time

- How Does BMO Harris Express Loan Pay Work?

- Sign Up For BMO Harris Express Loan Pay : A Step-By-Step Guide

- Types Of Loans Available From BMO Harris Express Loan Pay?

- 1. Short-Term Loans

- 2. Medium-Term Loans

- 3. Long-Term Loans

- BMO Harris Express Loan Pay Requirements

- How To Pay Loans Using The BMO Harris Loan Pay App?

- Conclusion

What Is BMO Harris Express Loan Pay, And How Do You Use It?

BMO Harris Bank is one of the oldest banks in the USA. Established in 1888, it has grown to become one of the largest private banks in the world. It has its headquarters located in Chicago. However, this bank is now famous for its intuitive BMO Harris Express Loan Pay service, an easier and faster way to pay off your loan dues.

Whether you wish to learn more about this service or want to use it as a BMO Harris Bank account holder, you have come to the right place. In this post, you will learn more about this service, including how to use it and the benefits you get.

What Is BMO Harris Express Loan Pay?

Does BMO Harris have quick pay? The answer is yes. BMO Harris Express Loan Pay is a fast and intuitive way to pay off your loans. Now you do not need to go to the BMO Harris Bank with a cheque or a suitcase full of cash. Instead, you can simply visit their online web portal and pay directly from there!

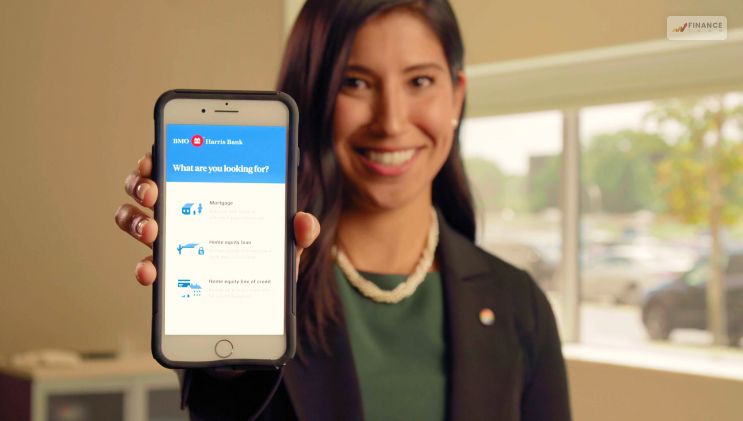

Besides being intuitive, it’s also pretty easy to do so. You only need a BMO Harris Express Pay account, the BMO Loan Pay app, and an internet connection. After that, you must use the application and follow the steps to make your loan payments on time.

Why Should You Use BMO Harris Loan Pay?

There are many benefits of using the BMO Harris Express Loan pay application to make timely loan payments. However, the primary benefits that you will be enjoying the most are:

1. Quick Transactions

Ever since the BMO Harris Express Loan Pay app started, it has become easier for customers to pay their loans. There is no need to go to the bank, wait in a queue, and get your chance to make payments. You can use this app now and make everything quicker. For added convenience, you will receive the payment confirmation receipt in the app!

2. High Levels Of Security

The Express Loan Pay application has been updated with extra security to secure your payments. BMO has always strived to ensure that your payments are made the most secure way possible. Therefore, this application has various layers of security to prevent hackers from accessing your BMO bank account and other information.

3. Ease Of Use

Since you can use the BMO App anytime you want from anywhere, it’s the easiest method of repaying your loans. This makes loan repayment a hassle-free experience. The app also has a clean and intuitive UI, making it easier for even the least tech-savvy people to navigate all the menus and make payments. You don’t need to ask others for help!

4. Cost Efficiency

It costs time and money to repay your loans to the bank. Plus, many banks have similar apps like the Express Loan Pay app. However, many of them charge service charges for using the app. Using the BMO Loan Pay app incurs no extra costs, making it accessible for everyone.

5. Saves Time

Instead of going to the bank to pay for loans, you can use this application. Therefore, using this app saves a lot of time and effort that you would have otherwise given to go to the bank physically.

How Does BMO Harris Express Loan Pay Work?

To utilize BMO Harris Express Loan Pay, follow these steps. Firstly, ensure you have an active checking or savings account with BMO Harris Bank and sign up for online banking. Access the service either through the BMO Harris mobile app or online banking on your computer, providing convenient online avenues for managing your loan payments.

The enrollment process for BMO Harris Express Loan Pay is straightforward. To meet the requirements, you must be the main account holder of a BMO Harris auto loan, aged 18 or older, and a U.S. citizen or permanent resident. During the account setup, furnish general information such as your name, email, phone number, address, and your BMO Harris auto loan account number. Additionally, choose a username and password for your login.

Security holds paramount importance in BMO Harris Express Loan Pay. The use of encryption and strong authentication measures ensures the protection of your information. The login process is meticulously designed to maintain the safety of your account details, instilling confidence in using the program.

Sign Up For BMO Harris Express Loan Pay : A Step-By-Step Guide

- Begin the process by visiting the BMO Harris Express Loan Pay website and locating the “Sign Up” button in the top right corner.

2. Provide the required information on the signup page, including your name, date of birth, address, and social security number.

3. Enhance the verification process by confirming the provided information using the security code sent to your email or mobile phone.

4. Create a robust and secure username and password for your account, ensuring a balance between memorability and security.5. After a successful signup, take advantage of the convenience of managing payments from the comfort of your home. This allows you to have control over your loan repayment experience, providing options such as making extra payments or utilizing tax refunds for timely repayments.

Types Of Loans Available From BMO Harris Express Loan Pay?

Using the BMO Harris loan payment online app, you can pay off three kinds of BMO loans. Based on their term of repayment, these loans can be categorized as:

1. Short-Term Loans

As the term suggests, these are short-term loans with lesser loan amounts. Since the loan amount is lesser, the repayment term is also lesser. People in need typically need these loans to pay off quick dues, like various monthly bills, debtors, and buying stuff you need. These loans usually have a repayment term of 3 to 12 months.

2. Medium-Term Loans

You might need a more significant loan to cover more considerable expenses. These can be used for buying cars, property, and other things where much money is required. Medium-term loans have a repayment period of 12 to 60 months (5 years).

3. Long-Term Loans

Entrepreneurs use this type of loan to set up their businesses and pay off debts. Many esteemed individuals can also take these loans to buy properties and more. The amount you get here is significant, with the loan repayment period being approximately 10 years.

BMO Harris Express Loan Pay Requirements

It’s pretty easy to start using this Express Loan Pay app. To do so, you must ensure that the following requirements are met:

- The first requirement, which goes without saying, is to have a BMO bank account.

- Next, you must already have a BMO loan sanctioned under your name. So far, only three types of loans can be repaid using this app – personal, home equity, and auto loans.

- Then, you must enable BMO Online Banking services.

- Finally, you must have your mobile number linked with your BMO Harris bank account and app.

How To Pay Loans Using The BMO Harris Loan Pay App?

To pay loans using the BMO Harris Express Loan app, you must first register your bank account with this app. Here’s what you need to do so:

- First, log in to your BMO Harris Express loan pay login.

- Next, navigate to the Payments & Transfers option.

- Then, click on the option Enroll in Express Loan Pay.

- Finally, follow all the instructions that appear on the screen to finalize the registration process.

After you are done with registering your bank account, you are ready to make your first loan payments. Follow the steps below to do so:

- First, log in to your BMO Harris net-banking account.

- Next, navigate to the Payments & Transfers option.

- Now, select what type of loan you wish to pay for.

- A new screen will open, asking you to enter the loan amount.

- After you do so, you will be asked to select which loan account it should be made from.

- Finally, the payment details will appear on the screen, and you need to review them before tapping the Submit Payment option.

Conclusion

Using the BMO Harris Express loan pay application has provided BMO bank account holders with loans with a more convenient, quicker, and more secure way of repaying their loan money. It’s pretty easy since you do not have to go to the bank and can do everything digitally!

Read Also: