How To Invest In Best Liquid Funds In 5 Simple Steps

While investment is the current rage, most investors do not have a high-risk appetite for the same. Besides, not all of them can be comfortable staying invested for the long term.

So what is the best way to work the investment out? It’s through Liquid funds.

If you are an investor who wants to go for short-term investment and generate higher returns or has just received windfall gains or a large sum of money at hand but is unsure about where to invest, liquid funds might be just the right option for you.

What are liquid funds?

Liquid funds are open-ended investment schemes, highly liquid in nature, offering a maturity period of just 91 days. These funds are considered safest among all mutual fund categories because of their ability to mitigate interest rate volatility risk.

Liquid funds invest in debt and money market instruments such as certificates of deposits, commercial papers, and treasury bills.

Taxation on Liquid funds:

Liquid funds come under debt funds, and hence they are taxable. The rate of taxation depends on how long you stay invested in a debt fund.

- Short-term capital gains (STCG): The profits made in the first 3 years of investment are short-term capital gains.

- Long-term capital gains (LTCG): The profits from investments held for more than 3 years are long-term capital gains. These gains get taxed at 20%, with the benefit of indexation.

In both cases, capital gains from funds get added to your overall income and then taxed according to your income tax rate.

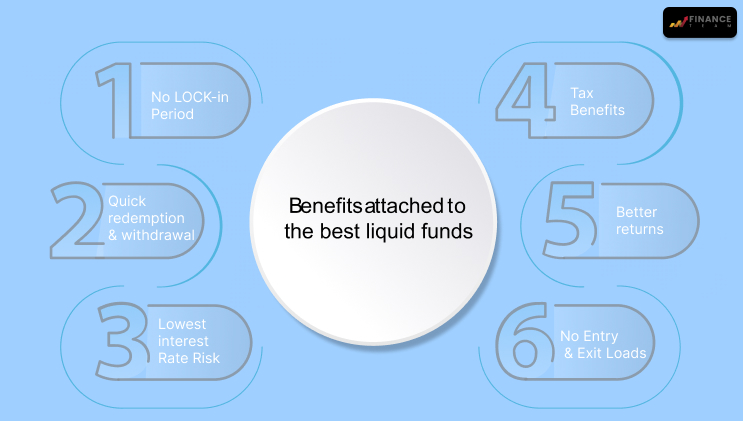

Benefits attached to the best liquid funds

- No Lock-in Period: One of the reasons they are called liquid funds, they have no lock-in period. They give full access to the cash through redemption.

- Quick redemption & withdrawal: As the name suggests, the best liquid funds can be dissolved quickly into cash. The process of redemption usually takes transaction day+1 day. As there is no lock-in period, you can redeem your liquid funds within one day of investment.

- Lowest Interest Rate Risk: Liquid funds come with a 91 say maturity duration, and hence they are exempted from interest rate fluctuations.

- Tax Benefits: Liquid Funds offer you considerable tax benefits compared to a saving account.

- Better Returns: Liquid funds offer an approximate return of 7-8% per annum.

- No Entry or Exit loads: No entry load is applicable. The exit load also is Nil. However, you must read the fund document to check the exit load, if any.

How to select the best liquid fund for yourself?

For selecting the best liquid fund, you need to check the following.

- Read the document thoroughly, and check the track record of a liquid fund, if it’s delivering consistently good performance and best portfolio quality or not.

- Check the expense ratio of those you find the best liquid funds. Funds with a lower expense ratio have a greater chance of offering better and higher returns.

- Check the investment portfolio of the fund you invest in for credit quality and liquidity for both the short and long-term.

- Also, check the fund size. The best Liquid funds are used often by institutional investors. If institutional investors initiate a large redemption, a small liquid fund can lose most of its assets, which will impact its ability to invest and generate returns. Hence, choose the liquid funds with more assets under management (AUM). Some of the best liquid funds include Quant liquid plan, Franklin India liquid fund, Mahindra Manulife liquid fund, IDBI liquid fund, and Edelweiss liquid fund

- The best Liquid funds are known for their ability in keeping the invested money safe and stable. Hence, investors must thoroughly assess the portfolio of a liquid fund and make sure that it is invested in different securities by different issuers. This will help you minimize the damage to the portfolio, in case any issuer makes any mistake.

Related Resource: What Are Specialty Funds? How to Invest In It?

How to invest in the best liquid funds?

An investor can make a liquid fund investment directly using the online platform provided by the fund house or broker or an intermediary platform like Glide Invest. You can either choose a regular direct investment plan. A direct investment plan allows you to save commission expenses and thus reduce the expense ratio.

To invest in best in the best liquid fund, you need to

- Decide on the amount and period of investment.

- Complete your e-KYC (Know Your Customer) formalities.

- Create an account by registering either on the AMC website directly or on an intermediary channel like Glide Invest

- Now, select your preferred liquid fund scheme for investment, the amount, etc. Investors can choose a lump-sum investment or start a systematic investment plan (SIP). For a SIP, you need to select the installment amount, investment date (monthly), the tenure of the SIP, & more

Hope you got an idea of how to invest in the liquid funds. Before you invest, make sure you compare and assess the available funds so that you invest in the best liquid fund, which offers you the lowest risk and return at your end.

Read Also: