Revocable Trust Vs Irrevocable Trust : Understand The Key Differences

In simple terms, a trust is a legal contract between a settler and a trustee to benefit a third party.

In this contractual setup, the property of the settler is being held onto by the trustee for the sake of one or multiple beneficiaries.

Trusts are mainly of two types – revocable trust vs irrevocable trust.

A revocable trust is one that can be up for termination only as long as the author survives.

An irrevocable trust is one that can not be canceled once created under any circumstances.

In a trust agreement, a trustee may only hold the assets as a nominal owner.

So, suppose you are planning on creating a trust for your family’s and your assets’ safety. In that case, you must be acutely aware of the differences between revocable trust vs irrevocable trust so that you can avoid any unnecessary hassle that may arise while you are here, or after your death.

What Is A Revocable Trust?

A revocable trust allows for modifications and cancellations at any time till the owner of the trust is alive. This caters to two main purposes – firstly, the trust owner will remain the owner of the transferred assets and exercise all controls over it, and secondly, the trust will only be handed over to the trust beneficiary after the owner’s death.

As the assets belong to the grantor’s estate, it is, therefore, taxable.

After the demise of the grantor, a revocable trust automatically becomes an irrevocable trust.

A revocable trust takes away the entire hassle of the probate process. This means it makes the assets easily get transferred to the intended beneficiaries.

Read More: How To Calculate Opportunity Cost? And What Is Its Use?

What Is An Irrevocable Trust?

An irrevocable trust is a lot stricter when it comes to the modifying benefits of the trust. According to the norms, an irrevocable trust cannot be subjected to any change, modifications, alterations, or termination once the agreement is signed and put into effect.

The asset that is once transferred to the trust can not be reversed. This means the grantor’s power to exercise control over the assets becomes zero.

One of the main reasons why grantors decide to get into an irrevocable trust agreement is because of the protection that it provides to the assets from creditors, as the ownership of the assets does not belong to the grantor anymore.

The other reason why grantors are more keen on creating an irrevocable trust is to prevent including their property as a part of the trust asset. This way, the assets within the trust stay protected from estate tax even after the death of the grantor.

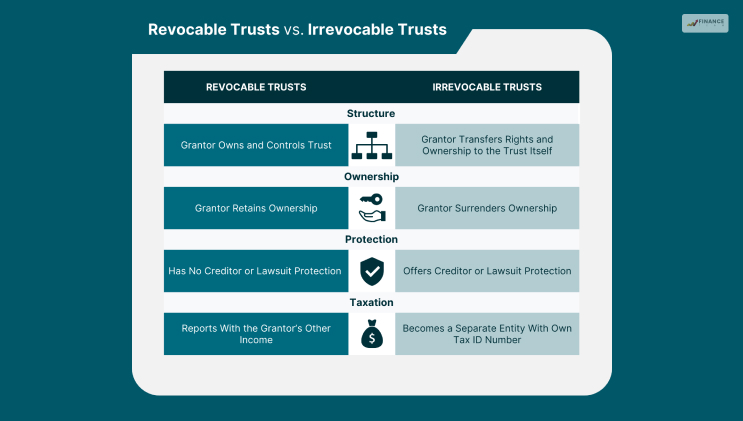

Revocable Trust Vs Irrevocable Trust: Comparison

To understand the difference between revocable trust vs irrevocable trust truly, you will have to build your knowledge step by step slowly. It is a learning process and takes time to achieve perfection.

However, I have crafted a chart that will help you understand the comparisons between revocable trust vs irrevocable trust.

Here are the main features of comparison that I have taken into account.

Definition

A revocable trust is one where the agreement may go through alterations and modifications as long as the owner is still alive. You may also call it a recoverable trust.

An irrevocable trust is one where no alterations or terminations are done once the bond is signed and put into effect.

Power And Control

The exercising power on the assets shall remain with the setter in case of a revocable trust.

However, in an irrevocable trust, the control over the assets transferred shall not remain with the settlers. Let’s Understand the types of trusts.

Objectives

A revocable trust takes away the stress of a probate process.

On the other hand, an irrevocable trust eliminates the estate tax on assets and properties.

Alternation Terms

You may change or alter the terms and conditions of a revocable trust anytime as long as the grantor is alive.

An irrevocable trust, however, cannot be put to alterations or modifications under whatsoever concerning circumstances.

Asset Protection

A revocable trust does not provide any protection for the assets.

However, an irrevocable trust provides complete protection for assets and properties.

Revocable Trust Vs Irrevocable Trust: Key Differences

Now that you’ve gone through the basic comparisons, it is time that you go through the points that we consider as the key differences between revocable trust vs irrevocable trust.

- While considering a revocable trust, you may alter or terminate it as long as the owner is alive. That means all alternation power lies with the survival of the owner of the trust. But when it comes to an irrevocable trust, under no circumstances can you alter an irrevocable trust or put it under termination. An irrevocable trust agreement is a one-time deal. If it’s done, it’s done.

- In the case of a revocable trust fund, the owner can still exercise their control over the assets even after transferring them to the beneficiaries. However, in an irrevocable trust, the owner loses all his control over the assets in the trust fund. The entire control automatically shifts to the irrevocable trust beneficiary.

- An individual opts for a revocable trust when he looks forward to getting a cut on the probation process; however, an irrevocable trust is an option for when individuals look to eliminate estate tax as the property ownership does not anymore remain with the owner.

- The terms and conditions of a revocable agreement can be altered whenever during the owner’s life. However, an irrevocable trust is a one-time deal. Once the individuals sign the papers and and puts it in action, there is no way that the terms and conditions can be put to alterations.

- Whereas a revocable trust does not provide any protection to property, an irrevocable trust protects the property from the hands of creditors. This is because the ownership of the property does not remain with the owner anymore.

Read More: Mastering Your Finances: Unlocking The Power Of Budgeting Worksheets

To Conclude

Everything has a positive and a negative aspect, and so does a revocable trust vs non revocable trust. While one eliminates probate, another protects assets and saves you from estate taxes.

For a trust owner to be able to make a choice between the two, he will have to be sure of his own demands from the trust. Only this way can the goals of the trust owner be fulfilled.

However, you must always consult trust owners before entering into a trust arrangement, who will guide you with better knowledge about the most recent amendments in the trust act.

Read More: