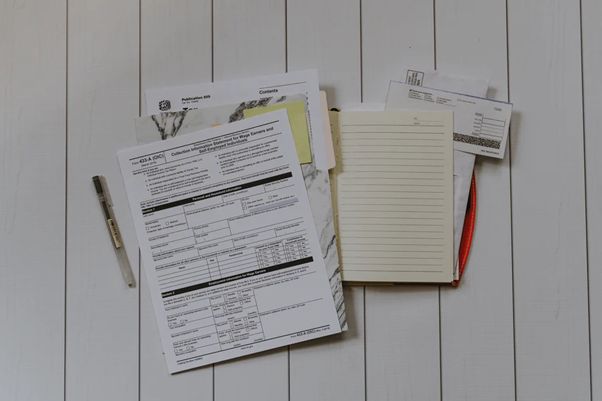

W2 Forms 101: The Essential Guide

October 14, 2021

US Judge Oliver Wendell once said, ‘Taxes are what we pay for a civilized society’.

All governments require an influx of capital to maintain the various elements that make a functional, safe and supportive society for all.

From employees to business owners, everyone pays their fair share based on their income and profits to the government. And shall, at least in theory, reap those benefits as the government puts those taxes to work to create, for example:

- Better education for all, increasing the skills and knowledge of the labor force.

- Parks and recreational activities for the public to enjoy in their free time and unwind.

- Numerous transport links to ensure the people have affordable and convenient ways to travel.

- Clean and sanitary public places to prevent sickness and the spread of diseases.

- Emergency services ensure an individual’s health and safety are protected and preserved with the utmost care.

As such, each business owner has an important responsibility to uphold their choice and commitment to operate in their chosen state. By keeping a record of their financials, submitting their income and profits to the government, and paying the appropriate tax.

To keep an accurate account of the companies money, owners or their bookkeepers and accountants are required to:

- Track, record, and organize business purchases, expenses, bills, wages, and income alongside the receipts and invoices for proof of transaction.

- Bank reconciliation to ensure that any mysterious or incorrect transactions are investigated and corrected.

- Identify and recoup late or missed payments from customers.

- Calculate sales tax returns, business income tax, and payroll taxes.

To calculate payroll taxes, in particular, employers must fill in a W2 form for each employee.

What Is A W2 Form?

Employers must fill in and forward a W2 document to the IRS, reporting an employee’s wages and taxes withheld to pay the tax office.

The W2 form is also referred to as a Wage and Tax statement. An employer is supposed to send this to each staff member and the IRS every year.

It’s a legal requirement of each employer to send this form to each employee and the IRS on or before the 31st of January.

This is, so the employee has enough time to file their income taxes before their deadline, which usually falls on the 15th of April each year.

Guidance For Filling Out A W2 Form

On the form, employers need to fill out the following details:

- Employees social security number

- Employer’s Identification number

- Employer’s name and address

- Control number

- Employees name and address

- Employees’ wages, tips. compensation, social security wages, Medicare wages, and social security tips, alongside the appropriate tax withheld which the employer intends to pay the IRS

- The remaining six boxes on the bottom of the form concern how much of an employee’s pay with be allocated to local and state taxes

Depending on the number of employees an employer has, filling in W2 forms can be pretty lengthy. Therefore, it may help to use a method that can speed up the process, such as pre-printed W-2 kits from Quickbooks.

Using the Quickbooks desktop, business owners can purchase and print W-2 forms pre-filled with the required information for each employee. And send these tax forms to the IRS and the employee before the January deadline.

Equally, each kit also contains a double window envelope to send the forms in and the documents can be printed from either laser or inkjet printers.

Having covered the significance of paying taxes for both business owners and employees. Directors need to fill in the W2 forms as accurately as possible to avoid mistakes and delays.

As mentioned, this process can be made much more straightforward by investing in pre-printed tax form packs.

Read Also: