- Key Learnings

- Understanding What Are Current Assets

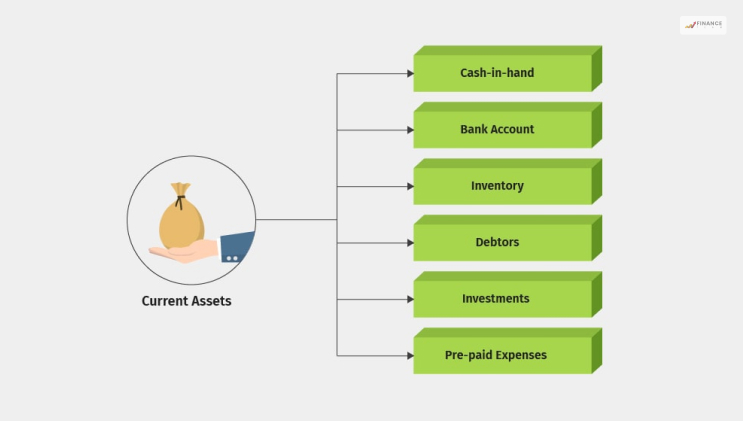

- What Are The Types Of Current Assets?

- Cash And Cash Equivalents

- Accounts Receivable

- Marketable Securities

- Inventory

- Prepaid Liabilities

- Other Short-Term Investments

- How To Calculate Current Assets?

- Why Are Current Assets Significant?

- Current Assets Vs. Non-current Assets

- The Bottom Line

What are current assets? And What is Its Significance?

Current Assets are those that a company owns, and can be converted into cash within one year. These items are placed in the Current Assets account on the balance sheet. The Current Assets account is a line item listed under the Assets sections in the balance sheet.

All the assets whose values are maintained in the Current Assets accounts are called Current Assets.

Current assets in a company include cash, stock inventory, cash equivalents, marketable securities, prepaid liabilities, accounts receivable, and extra liquid assets.

Key Learnings

- The account listed under the Assets section in the balance sheet, where the company can record only those items that can be converted into cash within a year through sales and liquidation, is known as Current Assets.

- These assets include cash, prepaid liabilities, marketable securities, cash equivalents, stock inventory, accounts receivable, and other liquid assets.

- Current Assets are necessary as they determine a company’s short-term liquidity and ability to pay its short-term commitments.

Read More: How To Calculate Gross Profit? – Explore With Example

Understanding What Are Current Assets

Companies that are publicly owned must follow the predominantly accepted accounting principles and reporting procedures. Adhering to these principles generates financial statements with particular line items that build transparency for interested parties.

One of these crucial statements is the Balance Sheet, which lists all the company’s assets, liabilities, and shareholder’s equity.

The Current Assets is the first account listed in the balance sheet under the Assets section. This section plays an important part for investors as it shows the company’s short-term liquidity.

Depending on the type of business and the products it provides, current assets can vary from barrels of petroleum, to inventory for works in progress, fabricated goods, raw materials, or foreign currencies.

What Are The Types Of Current Assets?

Although many assets are considered current by different businesses throughout industries, there are groups of current assets that are more common than the others:

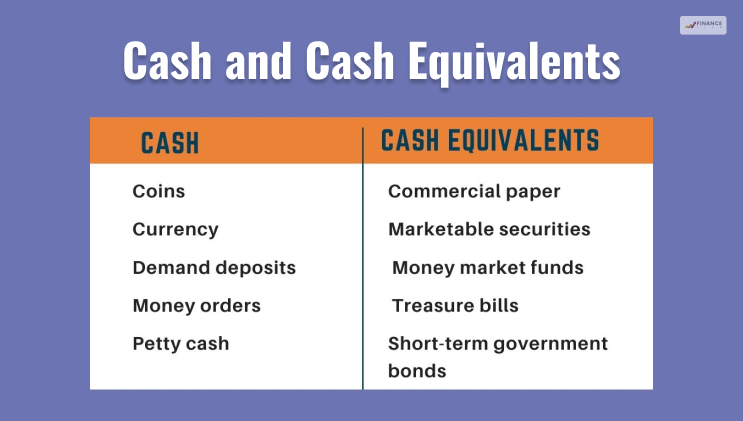

Cash And Cash Equivalents

“Is cash a current asset?” is a question many might ask. To answer your question- yes. All the assets in the Current Assets account are either cash or times that can be easily converted into cash.

Certificates of deposit, short-term government bonds, money markets, and treasury bills fall under cash equivalents. To qualify as a current asset, these items must not fall under any restrictions that hinder their short-term liquidity.

Accounts Receivable

As the name suggests, it is the value of money due to a company in exchange for goods or services provided. They can be considered current assets only if they are expected to be paid within a year.

If a company makes sales by offering longer credit terms to the customers, some of the receivables may not be included under the current assets account.

Marketable Securities

The account where the total amount of liquid investments easily converts into cash without reducing their market value is Marketable Securities.

If the shares of a company are trading in limited volumes; it would not be possible to convert them into cash without impacting their market value. Therefore, these shares are not liquids or enter into the Current Assets account.

Inventory

Inventory comprises the raw materials, finished products, and other components and has its place under the Current Assets account. However, you can adjust inventories by different accounting methods. Many times it may not be as easily liquidated as other current assets. That depends on the products and the type of industry it belongs to.

For example, units of high-cost earth-moving equipment have no liquidation guarantee within a year. But there is a better chance of a high sale of a thousand umbrellas in the upcoming rainy season.

Prepaid Liabilities

Also known as prepaid expenses, these liabilities represent those payments made by the company in advance for the goods and services they are yet to receive.

Other Short-Term Investments

Many businesses classify liquid investments in the Marketable Securities account, whereas some account for it in the Other Short-Term Investments account.

A perfect example would be excess investment of funds in short-term security, which will put the funds to work and, at the same time, keep the option of accessing them open.

How To Calculate Current Assets?

The total current assets formula is the simple addition of all the assets that converts into cash in one year. If any sub-part of the current asset is missing, you can take it from the balance sheet and add it to Other Liquid Assets.

Current Assets Formula

Current Assets= C+AR+CE+I+PE+MS+OLA

where,

C= cash

AR= accounts receivable

CE= cash equivalents

I= inventory

PE= prepaid expenses

MS= marketable securities

OLA= other liquid assets

Why Are Current Assets Significant?

One of the big reasons current assets are significant for the business is because the funds provided by the current assets help drive the company’s daily operational expenditures and other short-term functioning expenses.

If a company cannot pay for these expenses, it will not be able to operate and will soon run out of business. Therefore, current assets are important to continue the healthy running of the business.

The ratio of the current assets to current liabilities influences liquidity, which helps to measure the ability of a business to meet its immediate short-term requirements. Therefore, current assets also help maintain the cash flow of the business.

Also, creditors and investors often pay attention to the current assets of a business, its cash flow, and liquidity when they calculate the values and risks accompanying while investing in the business.

Current Assets Vs. Non-current Assets

In simple terms, current assets are the assets present in a business that they can convert into cash within one year. Whereas non-current assets cannot be converted into cash in a year.

While accounting for a balance sheet, you may notice that some same asset accounts are present both under Current and Non-current Assets. This happens due to the long-term tie-up of these assets, such as Marketable Security funds that businesses cannot sell within a year or will fetch an amount much less than their market value.

Plants, buildings, property, equipment, or other liquid investments, are all examples of non-current assets as they generally take a significant amount to sell. Whereas current assets are valued at their market price, non-current assets are valued at their purchased price as they depreciate over time.

Read More: How To Calculate Net Sales? – A Step By Step Guide

The Bottom Line

By now, you are clear about what current assets are and their significance in any business.

They are the assets under the Current Assets account in a company’s balance sheet. And can generate short-term profit and cash flow.

Current assets are important as they are necessary for the smooth functioning of a business. They meet the short-term obligations of the business.

It is impossible for any business to operate successfully if it lacks current assets in its operations.

Read Also:

- Gross Sales Vs Net Sales: What Is The Difference? How To Use Gross & Net Sales On Business Statements

- What Is Total Revenue Formula? – Definition, How To Calculate, And More

- How To Calculate Revenue? – Explain With an Example