How To Calculate Gross Profit? – Explore With Example

May 18, 2023

How to calculate gross profit?

Businesses worldwide need to calculate the gross profit to evaluate their efficiency in using their resources to produce the company’s goods and services.

It is an important metric listed in the income statement of a business. If you are creating a financial statement for a company or are just curious to know how gross profit works, this article should be helpful.

Here, I have listed the gross profit formula and provided a step-by-step guide for calculating gross profit.

What Is Gross Profit?

Gross profit, also known as a company’s gross income, is important data for a business. This data is pulled by deducting the total cost of goods sold (COGS) from the total revenue a company could generate within a specific timeframe (usually a year).

This data is important for a business, and it is listed in the income statement of any company when the financial information gets drafted. This profit is also named sales profit.

These important metrics of the business provide insight into her different metrics of the same. Here are some of the key factors you must know about the gross profit –

- It provides information about the capability of a business’ manufacturing and delivering processes of their product. A high gross profit means the company can leverage its resources to its maximum output.

- The gross profit is calculated by subtracting the COGS from the total revenue.

- Fixed expenses like insurance are not considered in the gross profit of a business. On the other hand, variable costs, such as shipping and material costs, can affect the gross profit of the same.

What Is The Formula For Gross Profit?

As I have already said, calculating gross profit is pretty simple. All you need is the COGS and the data related to your business’s total revenue to calculate the gross profit. Here is the formula you need to memorize.

Gross Profit = Total Revenue – Cost of Goods Sold or COGS

Now, as you can see, there are two different metrics you need to have an idea about –

- Revenue

- Cost of goods sold

Here is a quick overview of both of these metrics –

Revenue

A company’s revenue is the amount of money the company has generated through a specific period by selling its different products or services. In short, it is the total amount of money a company generates through its yearly sales. This amount is generated within a specific timeframe, like months or quarters.

The revenue is the amount from the sales before any deduction is made. It is counted in dollar amounts generated through annual, quarterly, or monthly product sales.

COGS

The COGS is the second necessary metric for the calculation of the gross profit of a company. If you are asking how to calculate gross profit, you should first understand how to calculate the cost of goods sold. This metric relates to the company’s cost while producing its products or services. Here are some examples of those different costs –

- Factory overhead

- Depreciation

- Production-related labor costs. (for example, factory wages for hourly or daily workers)

- Storage

- Materials

- Packaging and shipping costs

- Sales-related commissions

- Sales-related fees.

However, you must know that the COGS does not include the fixed costs that must be paid regardless of the output or production.

Here are some of the fixed costs included in the production of the goods or services –

- Marketing and advertising

- Labor costs indirectly connected to production (for example, executive salaries)

- Administrative costs

- Insurance

- Software

- Rent

- Office Supplies

- Depreciation

- Amortization

- Property Taxes

- Dues

- Equipment leases

- Interest charges on loans

- Utilities

- Subscriptions

How To Calculate Gross Profit?

Now that you understand what the gross profit is and the metrics and data needed for their calculation, you have to go through the step-by-step process mentioned below –

Step 1

First, you have to calculate the net revenue. To do this, you have to determine the total gross sales done within the period you calculate the gross profit for. So, make a list of total goods sold within that time and calculate the revenue collected from those sales.

Step 2

Now, you have to determine the sales cost the company has achieved on the variable costs. That requires you to determine different variable costs like depreciation, factory overhead, and more (mentioned earlier) and sum them up.

Step 3

So, how to calculate gross profit from here? It is simple. You must use the gross profit calculation formula to determine the gross profit.

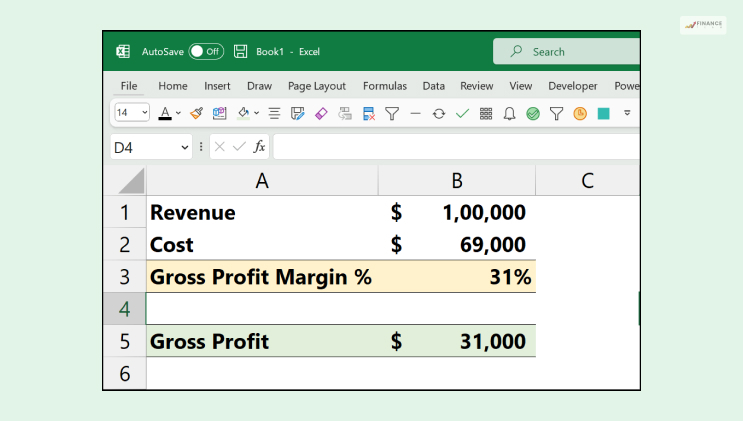

How To Calculate Gross Profit? : Example

So, let’s say you are calculating the gross profit for a toilet paper business. It is a medium-sized company in the industry, and they generate a decent amount of total revenue every year.

So, if you are following the step-by-step process of calculating the gross profit, you must first gather the total amount the company generated in revenue before any deductions. Once you go through the sales data, you will have a clear idea of how much the business has generated in revenue. Let’s say the company has generated $500000 in revenue in this case.

For the next step, you have to calculate the COGS of the company. This cost will include all the costs the company incurred while selling and manufacturing its toilet papers. You must also exclude all the fixed costs, as mentioned before.

So, the COGS will usually include the factory overhead, depreciation, and other similar costs. Let us assume the company incurred $30000 in COGS within that year. You know how to calculate gross profit once you have total revenue and the COGS.

So, if we apply the gross profit formula, the answer will be –

$50000 – $30000 = $20000

The gross profit for this company would be then $20000.

Read More: Cash On Cash Return Calculator: Maximize Real Estate Investment Profits

Bottom Line

Once you go through the steps and the formula explained in this article, you will understand how to calculate gross profit for a business. Please understand that this simply explains how grass profit is calculated. I have discussed the elements you need and the process you should follow to calculate gross profit.

I hope that this article was helpful. However, if you need us to answer any of your queries related to the topic, please reach out through the comment section.

Read More: