- What Is Giggle Finance?

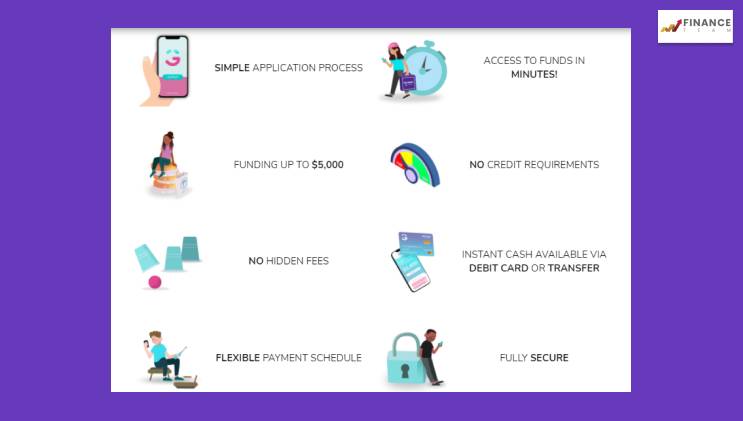

- What Are The Product Features Of Giggle Finance?

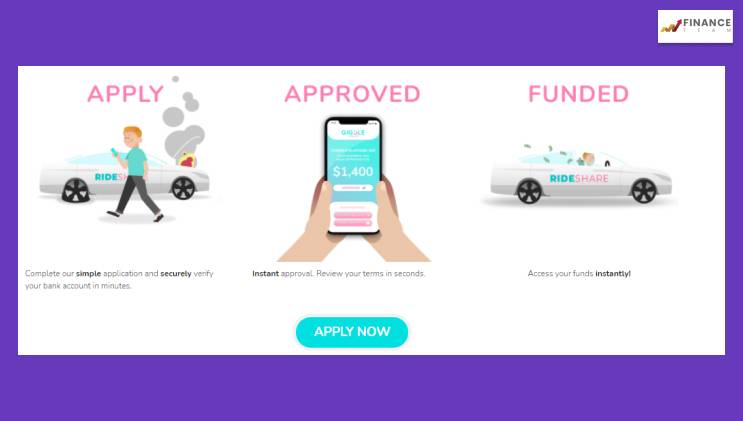

- How Does Giggle Finance Work?

- Why Choose Giggle Finance?

- 1. Simple Application Process

- 2. Completely Secure

- 3. Flexible Payment Schedule

- 5. No Credit Requirements

- 6. Access Your Funds In Minutes

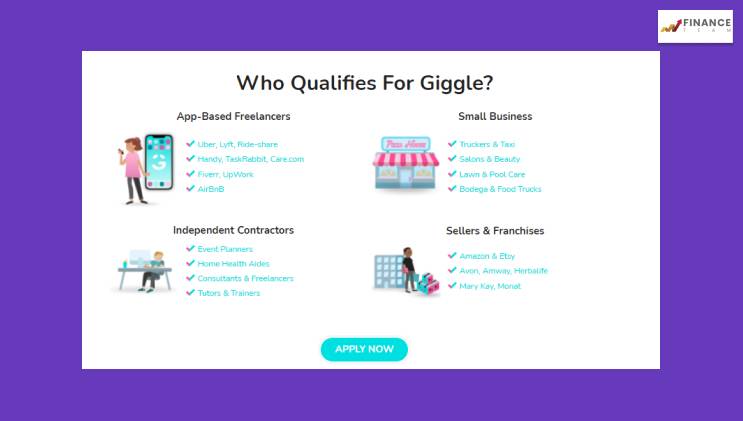

- How To Qualify For Giggle?

- 1. Complete The Online Application

- 2. Wait For Approval

- 3. Get Your Giggle Advance

- How To Choose A Giggle Advance?

- 1. Increase Working Capital

- 2. Purchase Or Lease Equipment

- 3. Inventory Purchases

- 4. Having A Cash Cushion

- 5. Marketing & Advertising

- The Final Thoughts

How Does Giggle Finance Work? – A Complete Guide

Are you a small business owner? Do you want finance for your startup? Do you know how Giggle finance works? Let’s discuss these queries in detail.

Small business owners face a lot of difficulties while starting a business. Lack of revenue is one of the most common causes why many businesses fail or sometimes even go bankrupt.

I agree that there are many online platforms available for loans but do all give you instant approval for loans and access to your funds? No, isn’t it?

Now, guess what? I have a better option for you where you get access to your funds immediately (less than an hour).

Yes, you heard it correctly! Here, I am talking about Giggle Finance, where you get instant funding for your business or any type of investment. Read below to know this in detail.

What Is Giggle Finance?

Giggle is an online finance platform where small business owners can ask for help and 1099 workers with instant access to capital. The customers at Giggle finance often look for 2000 dollar loans and 500 dollar loans.

The platform advances upto $5,000, which can provide adjustable terms to small business owners. Giggle Finance is here for you whether you require extra cash to pay for unexpected expenses or address cash flow issues.

What Are The Product Features Of Giggle Finance?

There are several product features of Giggle Finance that you must know at your end. Some of the core features of the Giggle finance are as follows:-

- You can avail of the simple process for application.

- Making a proper assessment of the funds in minutes is possible with Giggle Finance.

- Funding is possible up to $5000.

- You do not have to pay credits for Giggle Finance.

- There are no fees hidden from the customers.

- Instant cash is available via debit card or transfer.

You need to get through the details of this article to have a better idea into it. You must not make your selection in grey. You should follow the right process that can make things easier and effective for you to make the right investments.

How Does Giggle Finance Work?

This platform works by helping freelancers, contractors, and small business owners to access instant working capital by selling a portion of their future sales.

Furthermore, the payment gets subtracted automatically from their account plus a little service fee until the loan is repaid in full. The best part about this platform is that you get access to funds in minutes.

Why Choose Giggle Finance?

At Giggle, the primary mission is simple, and you get fast and transparent finance to your business. Here, we have listed various reasons why you should choose Giggle finance.

1. Simple Application Process

The Giggle Application process is very simple and easy to use. The application process is designed in such a way as to fit your busy schedule. Other application process grabs much of your time, but you can consider this platform without any hesitation.

2. Completely Secure

The giggle platform is completely secure and safe to use. The system uses 256-bit encryption, which means that your data cannot be stored or displayed at any cost. This platform is the fastest and the safest way to fund your business.

3. Flexible Payment Schedule

You don’t have to worry about due dates or late payment penalties. The payments are automatically deducted from your account at the end of every month.

4. No Hidden Fees

Giggle Finance’s core values are integrity and transparency. What you see is what you always get. The best part about this platform is that you are not charged extra money after the completion of the registration process.

5. No Credit Requirements

Yes, you don’t require a good credit score to qualify for a 500 dollar loan. They will only review your bank statements to know how much you will be able to borrow for your gig.

6. Access Your Funds In Minutes

The platform is for both business owners and freelancers who need immediate access to large capital. You can qualify for up to $5,000 and access your funds in minutes.

How To Qualify For Giggle?

The two main requirements in your 500 dollar loan application are:

- Minimum three months in business

- Bank account with online access.

The online application of this finance only takes around eight minutes to complete. You just need to tell them about your business and connect your banking information securely. You get instant funds after you get approval.

Now, to qualify in Giggle, you need to follow the simple steps below:

1. Complete The Online Application

At first, you are required to complete the online application by entering your basic data—however, no need to worry about privacy because your data is never stored or displayed anywhere.

2. Wait For Approval

As soon as you submit your application, approval is awarded immediately. At the same time, you need to review the rates and terms and how much you qualified for.

3. Get Your Giggle Advance

After the approval, you will get the money into your account instantly. Thus, this is the final step of the Giggle qualification.

How To Choose A Giggle Advance?

The most common ways to use Giggle advance are listed below:

1. Increase Working Capital

Increasing working capital is one of the primary reasons why gig workers consider this loan type. Seasonal sales and inconsistent revenue can negatively affect your cash flow. Hence, you can use the funds to pay your day-to-day expenses.

2. Purchase Or Lease Equipment

Equipment purchases and upgrades are vital for efficient operations. Startup costs are not everyone’s cup of tea, and this is the reason why you need Giggle finance to get the job done for you instantly!

3. Inventory Purchases

Inventory purchases also require large capital, and you can use the money of Giggle finance to pay for the same within no time.

4. Having A Cash Cushion

There are fluctuations in business that directly affects the business revenue. As a result, it disturbs the peace of mind and encourages you to make inappropriate business decisions. Thus, giggle’s finance instant approval can relax your mind.

5. Marketing & Advertising

Marketing and advertising cost a lot of money when you startup. This is an essential investment because it increases your brand awareness, visibility, and trust. So, the Giggle finance platform will provide you with an opportunity to pay for those investments.

The Final Thoughts

Giggle finance is one of the most secure platforms for business owners, and freelancers and many marketers are already aware of it. You can apply to this platform and get funded in minutes for your startup or business.

Hence, this information is all about how Giggle works and helps you to secure your business from bankruptcy. Still, if you face any difficulties, ensure to ask them in the comment section below!

Read Also:

All Comments

Milan Kinlaw

23 June, 2024

I believe you have remarked some very interesting details , thankyou for the post.

Milly Hartog

3 July, 2024

Hello my family member! I want to say that this article is amazing, great written and come with almost all important infos. I would like to look extra posts like this .

Dominga Bartel

4 July, 2024

I love forgathering useful info, this post has got me even more info!

Ethelene Tu

27 July, 2024

Great write-up, I am normal visitor of one’s website, maintain up the nice operate, and It is going to be a regular visitor for a long time.

Weston Shamsiddeen

28 July, 2024

we should always be updated with current events because it is important for us to know the latest issues~