- What Is Terrace Finance?

- Why Should You Consider Terrace Finance?

- What Products Are Eligible?

- Requirements To Be Eligible For Terrace Finance

- How Consumer Lease Financing With Terrace Works?

- Step 1: Shop

- Step 2: Begin The Application

- Step 3: Submit Documentation

- Step 4: Complete The Financing

- Is Terrace Finance Legit?

- The Final Thoughts

How Does Terrace Finance Work? – A Complete Review

December 21, 2021

Terrace finance is a multi-lender platform that helps merchants and customers to find the right payment solution regardless of their credit profile.

This finance firm is standing right behind you and serves a network of merchants and equipment dealers, focusing on the things you require the most. Both small and personal business deals are managed by the automated system.

Let’s discuss below the work procedures of this finance company in detail.

What Is Terrace Finance?

Terrace Finance is a platform that helps many clients and customers in finding the correct payment solutions for all customers. This platform is particularly created to streamline the confusion process and find the correct finance option for your purchase.

The process routes appetite-specific applications properly, resulting in lower costs, higher approval rates, and smarter decisions for partners. This curates a complete spectrum of lenders with various specialties.

Moreover, borrowers are matched to lenders based on what they are financing via a single application.

Why Should You Consider Terrace Finance?

Terrace finance has an entire division dedicated to agriculture equipment, maintenance, and landscaping. This shared lending platform is designed to make it easy for applicants to establish appropriate funding for goods and services via a chain of participating merchants.

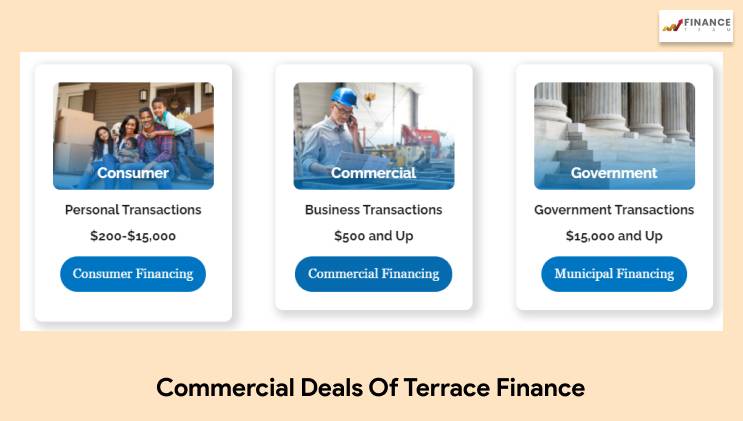

Commercial deals of $15,000 and more are managed by the commercial expert team. At the same time, there are numerous programs to meet your needs, and you need to consider the same.

Now, let’s discuss some major reasons to consider terrace finance.

- Multi-item bundling available

- There are various lending products, including working capital

- Network of financing companies to match your need

- All credit profiles are considered

- Any dollar amount above $200

- Financing for all kinds of buyers (personal transactions, government transactions, and business transactions).

What Products Are Eligible?

As already discussed above, terrace finance serves a network of equipment dealers particularly in the things you require. Below listed are some types of items the firm finance.

- Office Furniture

- Home Furniture

- Appliances

- Fitness Equipment

- Generators

- Computers & Electronics

- Fine jewelry

- Grills

- Lawn & Garden

- Pools & hot tubs

- Pets

- Sheds

- Tire & Automotive.

Requirements To Be Eligible For Terrace Finance

Yes, there are some requirements needed to pass the eligibility for terrace finance. Below listed are some factors to consider before filling the form online.

- Photo ID stating that you are at least eighteen years of age.

- Valid email address and phone number

- Valid Taxpayer ID Number or Social Security Number.

- At least $12,000 Annual Gross Income

- Electronic payment procedure.

In addition to the above requirements, you may be requested for more information to be eligible for some lending goods. Besides, there are some more requirements that you need to qualify for this finance.

- A credit score of 550 or higher

- Checking account for a minimum of 1 month where income is deposited

- Monthly net income of $1300 or more

- Six months on the job as a W-2 employee or twelve months as a W-9 contractor.

How Consumer Lease Financing With Terrace Works?

Terrace finance is not itself a lender, and yes, it represents numerous lenders, and customers have a greater chance of getting approved. With the help of only one application and a soft credit pull, you will resemble a lender based on your needs and credit profile.

In addition, this platform has a stronger relationship with manufacturers and retailers who offer financing. Now, the application process for the same are listed below:

Step 1: Shop

Fill out the Terrace Finance online application via your chosen merchant’s link or visit the direct official website of Terrace if you still haven’t chosen any merchant. The firm will work with any finance or on-liner retailer to complete your purchase.

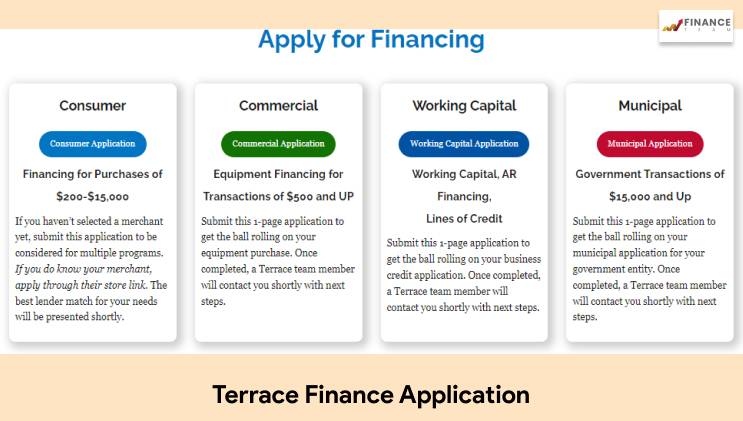

Step 2: Begin The Application

Another step is to begin the application form submission. Type the type of application and financing you require. This means you act as an intermediate between a bank and a merchant.

Step 3: Submit Documentation

To submit the documentation, you need to follow the below steps:

- Enter name, address, and phone number

- Birthdate is mandatory

- Employment info

- Employment info

- Bank routing number

- Driver’s license

- Social security number

Step 4: Complete The Financing

After accepting the official letter from the lender, the firm helps to achieve the deal by promoting the merchant to submit an invoice. Here, you need to read the terms and policies carefully before accepting the deal.

When the notification of funding is received from the lender, the merchant can release the goods.

Is Terrace Finance Legit?

The website of this finance company still exists and looks genuine. If you will read the Google reviews, the maximum is positive responses from customers. Excellent support is provided at the same time.

The platform also has a good social media presence on Facebook, LinkedIn, Twitter, and Instagram. Hence, the reviews claimed that the website was legit. But you must read the complete information about the same in detail.

The Final Thoughts

First, you need to keep in mind that Terrace finance is not a lender. The platform is committed to providing the best payment solutions to clients. Hence, this is all about Terrace Finance and its work procedures that you should know before applying.

Also, don’t forget to ask your doubts below in the comment section!

Read Also: