- An Overview Of The Brand Nykaa

- Facts And Findings Of Nykaa IPO

- The Launch Date Of The IPO

- The Expected Share Price Of The IPO

- What Are The Steps To Apply For Nykaa IPO?

- Frequently Asked Questions

- Q1. What Are The Possible Benefits Of Nykaa IPO?

- Q2. Will The Nykaa IPO Listing Date Be Announced At Any Time?

- Q3. Is Nykaa’s IPO Safe To Invest?

- Q4. What Are the Disadvantages of Nykaa’s IPO?

- Wrapping It Up

Nykaa IPO Review: Nykaa IPO Launch Date & IPO Price

Are you aware that Nykaa, India’s largest lifestyle, and fashion retailer, is aiming to find a place on the stock exchange list? Yes, you heard it right! After Zomato IPO, now it’s time for Nykaa Initial Public Offering (Nykaa IPO), says the financial experts.

Recently the Securities and Exchange Board (Sebi) has received Nykaa’s draught red herring prospectus. Bankers are hoping that the Nykaa IPO would bring fresh lucrative shares of up to Rs 525 crore. In addition, it may also comprise a total revenue of 4.31 crore shares.

Don’t you want to know more details about the IPO of this omnichannel giant? We are here to give you answers to your queries today. So today’s post will cover the following.

- An overview of the brand Nykaa

- Facts and findings of Nykaa IPO

- The Launch Date of the IPO

- The expected share price of the IPO

- What Are The Steps To Apply For Nykaa IPO?

- Frequently Asked Questions

An Overview Of The Brand Nykaa

The multichannel Indian beauty, wellness, and fashion E-commerce brand started its journey in 2012 under the leadership of Falguni Nayar. Being headquartered in Mumbai, it started to grow aggressively since its inception and is still growing in leaps and bounds. In the previous year, this unicorn startup’s value was the US $1.2 billion.

The year 2015 was a blessing for Nykaa. Apart from opening offline retail stores, it attained the ‘omnichannel marketer’ tag and began expanding its product offerings. At present, it sells 200,000 products from 2000 brands across both offline and 70 online stores in the country.

Currently, it is concerned with the IPO that will launch soon in the Indian market and looking forward to bringing a massive valuation.

Facts And Findings Of Nykaa IPO

Here are some key takeaways about the Nykaa IPO that you would never want to miss. Let’s check out one by one.

- Nykaa has collaborated with Morgan Stanley and Kotak Mahindra Bank to coordinate the IPO.

- The team is anticipating a valuation of $3.5 billion from the IPO with a sale of $500-700 million.

- In addition to the National Stock Exchange, it is targeting the Bombay stock Exchange listing as well.

- After the issuance of IPO, Nykaa is hoping to experience a growth of approximately 40% in this pandemic hit quarter.

- Fidelity Management, Research CO., and Hero Enterprise are also supporting Nykaa in this matter of IPO.

- Falguni Nayar’s spouse – Sanjay Nayar and their two children possess a majority share in Nykaa with about 53% ownership.

The Launch Date Of The IPO

The Nykaa IPO date in India is still unannounced. But, most probably, Nykaa would publicize the much-awaited date soon. As per their recent press conferences, the date will be somewhere between the end of 2021 and the beginning of 2022.

Several investors have already got attracted by the deal, especially Fidelity management and Hero Enterprise. However, the list of investors may be quite long due to such a profitable valuation.

So as of now, brace yourself and wait for the Nykaa IPO date to be published shortly.

The Expected Share Price Of The IPO

This is one of the most interesting points to talk about. Although the prospectus of the IPO is not drafted yet, considering the forecasts, it can be the biggest IPO of the year. So at present, all the shareholders are just holding their breath for the share price.

The CEO Falguni Nayar has commented that this IPO would take the company to the next level. She also commented that Nykaa’s IPO is trustworthy, and investors can put money into Nykaa’s stocks while closing their eyes. The projected share price of the IPO might be 3 times more than the investor’s initial investments.

What Are The Steps To Apply For Nykaa IPO?

By now, I hope you have got the fundamental details of the Nykaa IPO. Now, if it has triggered your interest, we are here with the application process in the IPO.

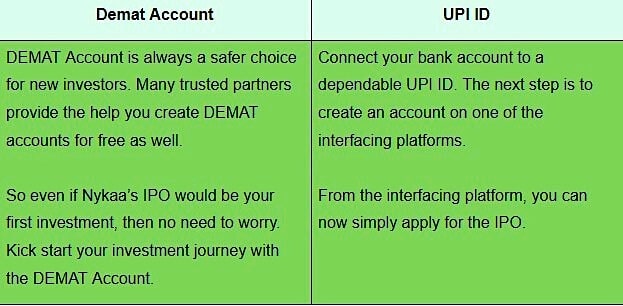

Before we proceed, remember that to apply, you need an interface for a seamless application procedure. Some of such trusted interfaces or stockbrokers are Zerodha, Angel One, Upstocks, etc. However, the best and most effective option is to apply through a Demat account. Please note the following steps to register yourself for Nykaa’s IPO:

Frequently Asked Questions

Q1. What Are The Possible Benefits Of Nykaa IPO?

This IPO will open a door of opportunities to both the companies and the investors. Huge incoming capital is waiting for companies that would raise their funds, lowering the corporate debts. On the other hand, it will be an excellent investment for the shareholders due to the colossal amount of returns.

Q2. Will The Nykaa IPO Listing Date Be Announced At Any Time?

The exact date is not known yet, but the date would likely be in the latter half of 2021.

Q3. Is Nykaa’s IPO Safe To Invest?

Nykaa has dominated the cosmetics and wellness market in India for the last 5-7 years. It is more of a brand than a company. Additionally, the existing reports state that Nykaa is about to make $539.7 million from the IPO. So if you want to invest in the IPO, it makes sense.

Q4. What Are the Disadvantages of Nykaa’s IPO?

The companies may face high auditing costs and a messed-up situation. Simultaneously, the investors require doing extensive market research that is quite time-consuming.

Wrapping It Up

To summarize, experts are saying that the Nykaa IPO will receive an overwhelming response in the country. Its brand identity and impressive financial health are the two answers to all of your doubts about the IPO.

I hope you found this article useful. Please forward it to anybody who might be interested in learning more about Nykaa’s IPO. Do you have any points of view that you’d like to share with us? Please feel free to leave a message in the space below. We will be in touch with you soon.

Read Also: